Stock Analysis

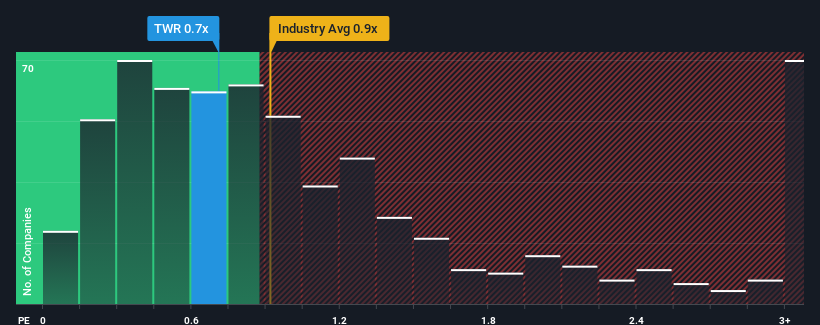

Tower Limited's (NZSE:TWR) price-to-sales (or "P/S") ratio of 0.7x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Insurance industry in New Zealand have P/S ratios greater than 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Tower

How Tower Has Been Performing

There hasn't been much to differentiate Tower's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Tower will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Tower will help you uncover what's on the horizon.How Is Tower's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Tower's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The latest three year period has also seen a 26% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 20% per annum. With the rest of the industry predicted to shrink by 2.6% per year, that would be a fantastic result.

With this information, we find it very odd that Tower is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tower currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching the positive outlook. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Tower that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Tower is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:TWR

Tower

Tower Limited provides general insurance products in New Zealand and the Pacific Islands.

Excellent balance sheet with reasonable growth potential.