Stock Analysis

Market Might Still Lack Some Conviction On Doppler S.A. (ATH:DOPPLER) Even After 34% Share Price Boost

Doppler S.A. (ATH:DOPPLER) shareholders would be excited to see that the share price has had a great month, posting a 34% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 10% is also fairly reasonable.

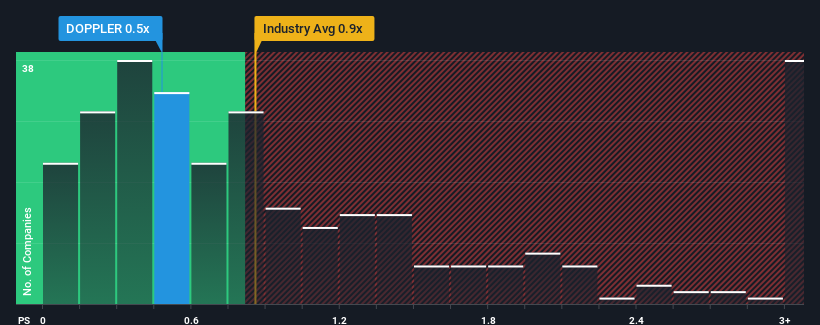

Even after such a large jump in price, it's still not a stretch to say that Doppler's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Machinery industry in Greece, where the median P/S ratio is around 0.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Doppler

How Has Doppler Performed Recently?

Doppler has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Doppler will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Doppler, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Doppler's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. The solid recent performance means it was also able to grow revenue by 13% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 0.2% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Doppler's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Final Word

Doppler's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Doppler currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Doppler that you need to be mindful of.

If these risks are making you reconsider your opinion on Doppler, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Doppler is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:DOPPLER

Doppler

Doppler S.A. engages in design, production, installation and maintenance of elevators, elevator components, and mechanical components and structures worldwide.

Fair value with imperfect balance sheet.