Stock Analysis

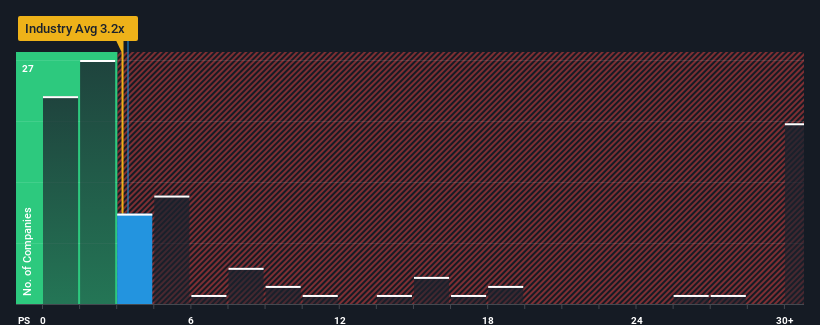

It's not a stretch to say that Marinomed Biotech AG's (VIE:MARI) price-to-sales (or "P/S") ratio of 3.4x right now seems quite "middle-of-the-road" for companies in the Pharmaceuticals industry in Austria, where the median P/S ratio is around 3.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Marinomed Biotech

What Does Marinomed Biotech's Recent Performance Look Like?

Marinomed Biotech hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Marinomed Biotech will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Marinomed Biotech would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 36% per annum during the coming three years according to the dual analysts following the company. That's shaping up to be materially higher than the 9.4% per year growth forecast for the broader industry.

With this information, we find it interesting that Marinomed Biotech is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Marinomed Biotech's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, Marinomed Biotech's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Marinomed Biotech you should be aware of, and 2 of them are concerning.

If these risks are making you reconsider your opinion on Marinomed Biotech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Marinomed Biotech is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About WBAG:MARI

Marinomed Biotech

Marinomed Biotech AG, a biopharmaceutical company, develops therapeutic products for indications in virology and immunology in Austria, other European countries, and internationally.

High growth potential and overvalued.