Stock Analysis

- United States

- /

- Medical Equipment

- /

- NYSE:FNA

Many Still Looking Away From Paragon 28, Inc. (NYSE:FNA)

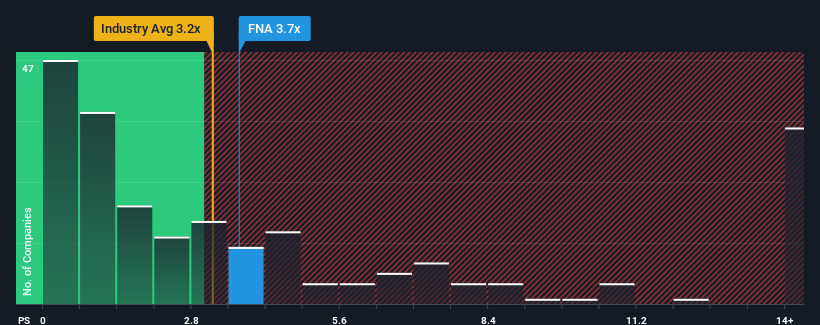

It's not a stretch to say that Paragon 28, Inc.'s (NYSE:FNA) price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" for companies in the Medical Equipment industry in the United States, where the median P/S ratio is around 3.2x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Paragon 28

How Has Paragon 28 Performed Recently?

With revenue growth that's superior to most other companies of late, Paragon 28 has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Paragon 28's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Paragon 28 would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. Pleasingly, revenue has also lifted 95% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 10% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Paragon 28's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Paragon 28's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Looking at Paragon 28's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 2 warning signs for Paragon 28 you should be aware of, and 1 of them can't be ignored.

If these risks are making you reconsider your opinion on Paragon 28, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Paragon 28 is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NYSE:FNA

Paragon 28

Paragon 28, Inc. develops, distributes, and sells foot and ankle surgical systems in the United States and internationally.

Fair value with mediocre balance sheet.