Stock Analysis

- Australia

- /

- Electric Utilities

- /

- ASX:LPE

Locality Planning Energy Holdings Limited (ASX:LPE) Held Back By Insufficient Growth Even After Shares Climb 100%

Locality Planning Energy Holdings Limited (ASX:LPE) shares have had a really impressive month, gaining 100% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 38% in the last year.

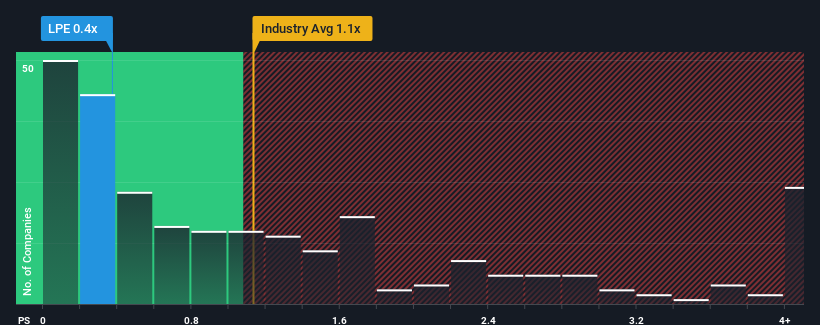

Even after such a large jump in price, given about half the companies operating in Australia's Electric Utilities industry have price-to-sales ratios (or "P/S") above 1.9x, you may still consider Locality Planning Energy Holdings as an attractive investment with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Locality Planning Energy Holdings

What Does Locality Planning Energy Holdings' Recent Performance Look Like?

For example, consider that Locality Planning Energy Holdings' financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Locality Planning Energy Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Locality Planning Energy Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 34% decrease to the company's top line. As a result, revenue from three years ago have also fallen 24% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 2.5% shows it's an unpleasant look.

With this in mind, we understand why Locality Planning Energy Holdings' P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Locality Planning Energy Holdings' P/S?

The latest share price surge wasn't enough to lift Locality Planning Energy Holdings' P/S close to the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Locality Planning Energy Holdings confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Locality Planning Energy Holdings (3 are significant!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Locality Planning Energy Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Locality Planning Energy Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ASX:LPE

Locality Planning Energy Holdings

Locality Planning Energy Holdings Limited provides electricity and utility services to residential and commercial customers throughout the Australian National Electricity Market.

Flawless balance sheet and good value.