Stock Analysis

- Hong Kong

- /

- Medical Equipment

- /

- SEHK:853

Little Excitement Around MicroPort Scientific Corporation's (HKG:853) Revenues As Shares Take 25% Pounding

MicroPort Scientific Corporation (HKG:853) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

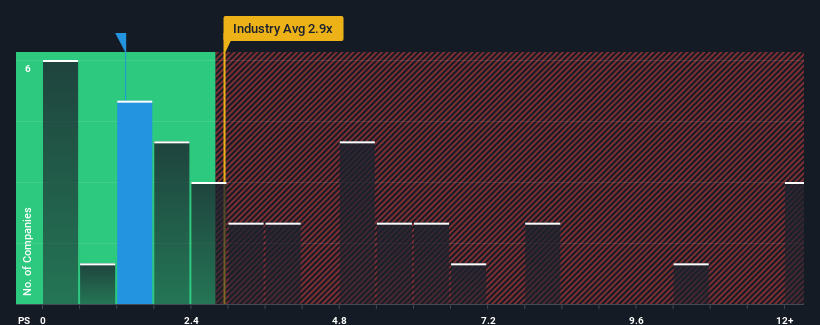

Following the heavy fall in price, MicroPort Scientific may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.3x, considering almost half of all companies in the Medical Equipment industry in Hong Kong have P/S ratios greater than 2.9x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for MicroPort Scientific

What Does MicroPort Scientific's P/S Mean For Shareholders?

Recent times haven't been great for MicroPort Scientific as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MicroPort Scientific.How Is MicroPort Scientific's Revenue Growth Trending?

In order to justify its P/S ratio, MicroPort Scientific would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 13% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 18% each year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 47% each year, which is noticeably more attractive.

With this information, we can see why MicroPort Scientific is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

MicroPort Scientific's recently weak share price has pulled its P/S back below other Medical Equipment companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of MicroPort Scientific's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

You always need to take note of risks, for example - MicroPort Scientific has 2 warning signs we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether MicroPort Scientific is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:853

MicroPort Scientific

MicroPort Scientific Corporation, an investment holding company, engages in the manufacture, marketing, and distribution of medical devices in the People’s Republic of China, North America, Europe, other Asian countries, South America, and internationally.

Undervalued with mediocre balance sheet.