Stock Analysis

Lacklustre Performance Is Driving Loqus Holdings p.l.c.'s (MTSE:LQS) Low P/E

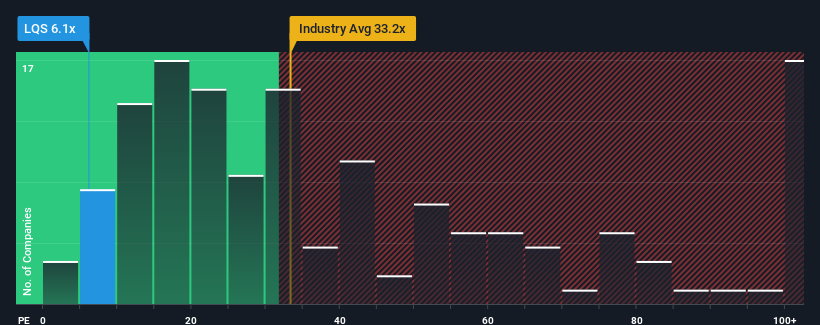

Loqus Holdings p.l.c.'s (MTSE:LQS) price-to-earnings (or "P/E") ratio of 6.1x might make it look like a strong buy right now compared to the market in Malta, where around half of the companies have P/E ratios above 16x and even P/E's above 21x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Loqus Holdings over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

View our latest analysis for Loqus Holdings

Is There Any Growth For Loqus Holdings?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Loqus Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 13% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Loqus Holdings' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Loqus Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Loqus Holdings (2 can't be ignored) you should be aware of.

You might be able to find a better investment than Loqus Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Loqus Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:LQS

Loqus Holdings

Loqus Holdings p.l.c., together with its subsidiaries, provides fleet management, back-office processing, and ICT solutions in Malta, Europe, the Middle East, South Africa, and Australasia.

Adequate balance sheet and slightly overvalued.