Stock Analysis

- Denmark

- /

- Medical Equipment

- /

- CPSE:EMBLA

Is Össur hf (CPH:OSSR) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Össur hf. (CPH:OSSR) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Össur hf

How Much Debt Does Össur hf Carry?

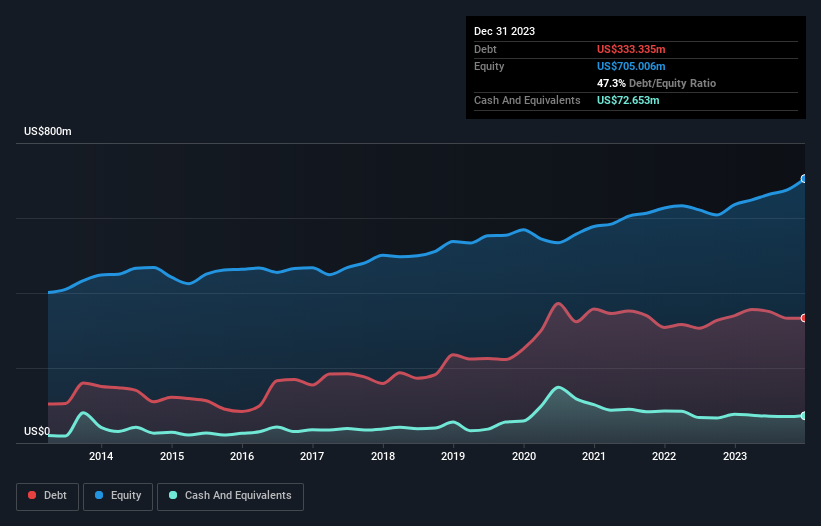

As you can see below, Össur hf had US$333.3m of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have US$72.7m in cash offsetting this, leading to net debt of about US$260.7m.

How Strong Is Össur hf's Balance Sheet?

According to the last reported balance sheet, Össur hf had liabilities of US$196.2m due within 12 months, and liabilities of US$484.5m due beyond 12 months. Offsetting these obligations, it had cash of US$72.7m as well as receivables valued at US$133.4m due within 12 months. So its liabilities total US$474.7m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Össur hf is worth US$2.13b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Össur hf's net debt is sitting at a very reasonable 2.4 times its EBITDA, while its EBIT covered its interest expense just 6.0 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. It is well worth noting that Össur hf's EBIT shot up like bamboo after rain, gaining 30% in the last twelve months. That'll make it easier to manage its debt. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Össur hf's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Össur hf produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, Össur hf's impressive EBIT growth rate implies it has the upper hand on its debt. But, on a more sombre note, we are a little concerned by its net debt to EBITDA. It's also worth noting that Össur hf is in the Medical Equipment industry, which is often considered to be quite defensive. Taking all this data into account, it seems to us that Össur hf takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. Over time, share prices tend to follow earnings per share, so if you're interested in Össur hf, you may well want to click here to check an interactive graph of its earnings per share history.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether Embla Medical hf is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About CPSE:EMBLA

Embla Medical hf

Embla Medical hf., together with its subsidiaries, provides non-invasive orthopedic products in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Proven track record and fair value.