Stock Analysis

- South Korea

- /

- Medical Equipment

- /

- KOSDAQ:A214610

Is MiCo BioMed (KOSDAQ:214610) Using Debt In A Risky Way?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, MiCo BioMed Co., Ltd. (KOSDAQ:214610) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for MiCo BioMed

What Is MiCo BioMed's Net Debt?

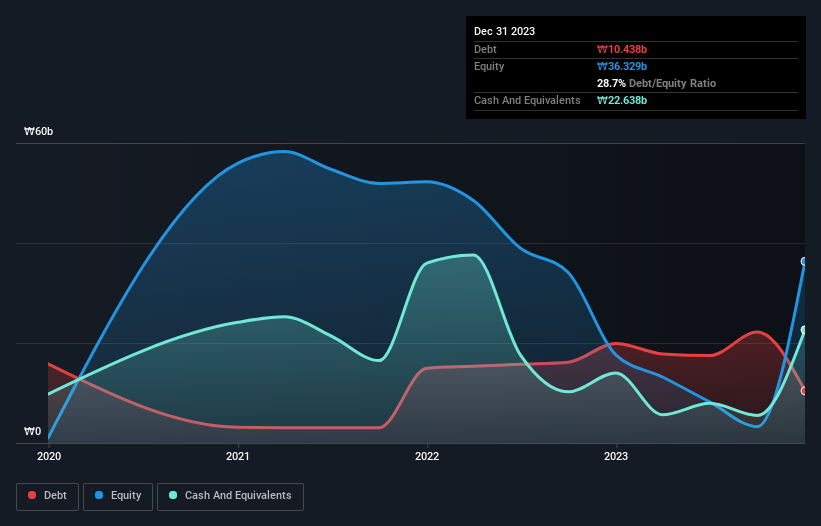

As you can see below, MiCo BioMed had ₩10.4b of debt at December 2023, down from ₩19.9b a year prior. However, its balance sheet shows it holds ₩22.6b in cash, so it actually has ₩12.2b net cash.

A Look At MiCo BioMed's Liabilities

The latest balance sheet data shows that MiCo BioMed had liabilities of ₩17.5b due within a year, and liabilities of ₩7.45b falling due after that. Offsetting this, it had ₩22.6b in cash and ₩10.1b in receivables that were due within 12 months. So it can boast ₩7.73b more liquid assets than total liabilities.

This short term liquidity is a sign that MiCo BioMed could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, MiCo BioMed boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since MiCo BioMed will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, MiCo BioMed made a loss at the EBIT level, and saw its revenue drop to ₩5.4b, which is a fall of 67%. That makes us nervous, to say the least.

So How Risky Is MiCo BioMed?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that MiCo BioMed had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through ₩12b of cash and made a loss of ₩26b. However, it has net cash of ₩12.2b, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 4 warning signs for MiCo BioMed (2 are a bit unpleasant) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether MiCo BioMed is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSDAQ:A214610

MiCo BioMed

MiCo BioMed Co., Ltd. provides on-site diagnostic systems based on Lab-on-a-Chip technology.

Excellent balance sheet and overvalued.