Stock Analysis

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Metrod Holdings Berhad (KLSE:METROD) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Metrod Holdings Berhad

What Is Metrod Holdings Berhad's Debt?

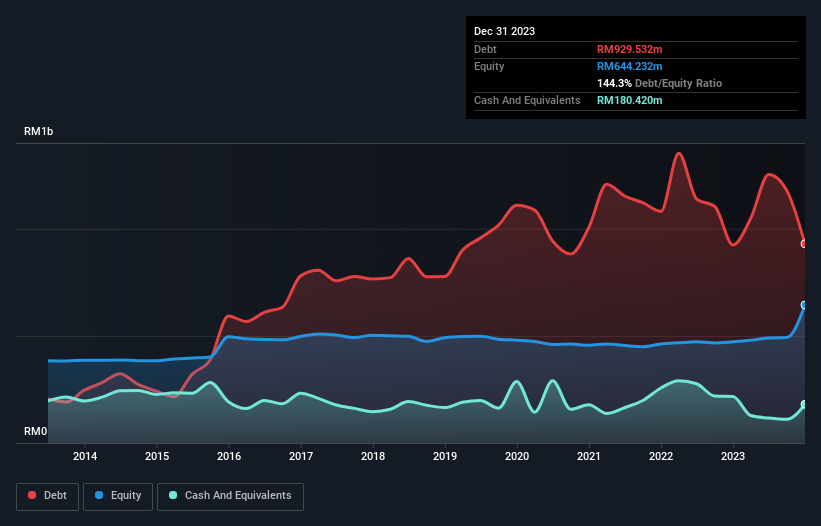

The chart below, which you can click on for greater detail, shows that Metrod Holdings Berhad had RM929.5m in debt in December 2023; about the same as the year before. However, it also had RM180.4m in cash, and so its net debt is RM749.1m.

How Healthy Is Metrod Holdings Berhad's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Metrod Holdings Berhad had liabilities of RM945.2m due within 12 months and liabilities of RM236.6m due beyond that. On the other hand, it had cash of RM180.4m and RM322.3m worth of receivables due within a year. So it has liabilities totalling RM679.1m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the RM171.6m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Metrod Holdings Berhad would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.0 times and a disturbingly high net debt to EBITDA ratio of 7.7 hit our confidence in Metrod Holdings Berhad like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. Even worse, Metrod Holdings Berhad saw its EBIT tank 26% over the last 12 months. If earnings continue to follow that trajectory, paying off that debt load will be harder than convincing us to run a marathon in the rain. There's no doubt that we learn most about debt from the balance sheet. But it is Metrod Holdings Berhad's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Metrod Holdings Berhad recorded free cash flow of 41% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

On the face of it, Metrod Holdings Berhad's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to convert EBIT to free cash flow isn't such a worry. We think the chances that Metrod Holdings Berhad has too much debt a very significant. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example Metrod Holdings Berhad has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're helping make it simple.

Find out whether Metrod Holdings Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:METROD

Metrod Holdings Berhad

Metrod Holdings Berhad, an investment holding company, manufactures and markets electrical conductivity grade copper wires, rods, and strips in Malaysia.

Mediocre balance sheet second-rate dividend payer.