Stock Analysis

- Brazil

- /

- Specialty Stores

- /

- BOVESPA:AMAR3

Is Marisa Lojas (BVMF:AMAR3) Using Too Much Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Marisa Lojas S.A. (BVMF:AMAR3) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Marisa Lojas

How Much Debt Does Marisa Lojas Carry?

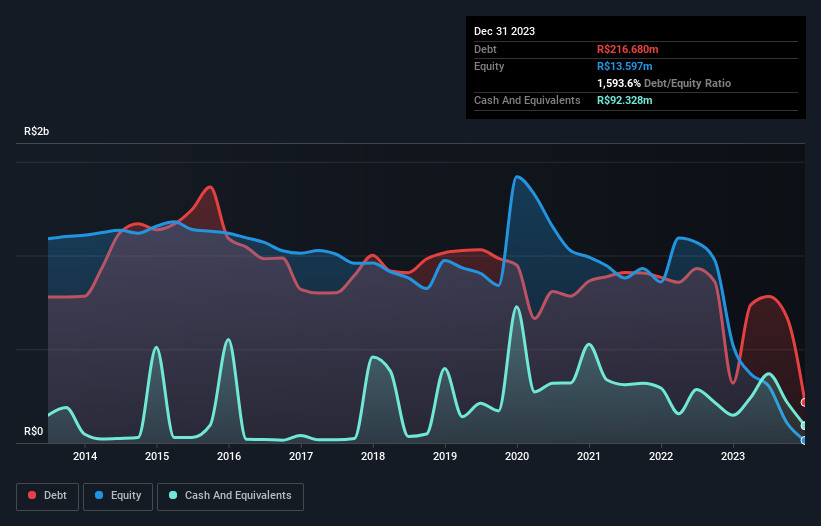

As you can see below, Marisa Lojas had R$216.7m of debt at December 2023, down from R$319.6m a year prior. However, because it has a cash reserve of R$92.3m, its net debt is less, at about R$124.4m.

How Strong Is Marisa Lojas' Balance Sheet?

We can see from the most recent balance sheet that Marisa Lojas had liabilities of R$1.57b falling due within a year, and liabilities of R$920.0m due beyond that. On the other hand, it had cash of R$92.3m and R$537.4m worth of receivables due within a year. So it has liabilities totalling R$1.86b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the R$102.8m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Marisa Lojas would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Marisa Lojas will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Marisa Lojas had a loss before interest and tax, and actually shrunk its revenue by 32%, to R$1.7b. To be frank that doesn't bode well.

Caveat Emptor

While Marisa Lojas's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable R$171m at the EBIT level. Reflecting on this and the significant total liabilities, it's hard to know what to say about the stock because of our intense dis-affinity for it. Sure, the company might have a nice story about how they are going on to a brighter future. But the reality is that it is low on liquid assets relative to liabilities, and it lost R$503m in the last year. So we think buying this stock is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example Marisa Lojas has 3 warning signs (and 2 which shouldn't be ignored) we think you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're helping make it simple.

Find out whether Marisa Lojas is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About BOVESPA:AMAR3

Marisa Lojas

Marisa Lojas S.A., together with its subsidiaries, engages in the retail of consumer goods in Brazil.

Good value with mediocre balance sheet.