Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:BCHN

Is Burckhardt Compression Holding AG's (VTX:BCHN) Latest Stock Performance A Reflection Of Its Financial Health?

Most readers would already be aware that Burckhardt Compression Holding's (VTX:BCHN) stock increased significantly by 19% over the past three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Specifically, we decided to study Burckhardt Compression Holding's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Burckhardt Compression Holding

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Burckhardt Compression Holding is:

32% = CHF78m ÷ CHF247m (Based on the trailing twelve months to September 2023).

The 'return' is the income the business earned over the last year. So, this means that for every CHF1 of its shareholder's investments, the company generates a profit of CHF0.32.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Burckhardt Compression Holding's Earnings Growth And 32% ROE

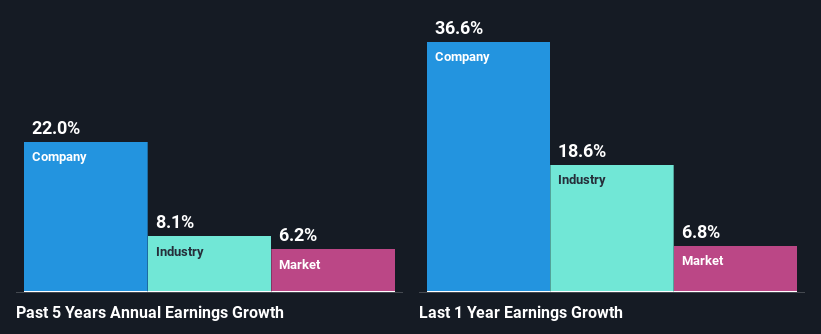

Firstly, we acknowledge that Burckhardt Compression Holding has a significantly high ROE. Secondly, even when compared to the industry average of 18% the company's ROE is quite impressive. Under the circumstances, Burckhardt Compression Holding's considerable five year net income growth of 22% was to be expected.

As a next step, we compared Burckhardt Compression Holding's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.1%.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Burckhardt Compression Holding's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Burckhardt Compression Holding Making Efficient Use Of Its Profits?

The three-year median payout ratio for Burckhardt Compression Holding is 49%, which is moderately low. The company is retaining the remaining 51%. By the looks of it, the dividend is well covered and Burckhardt Compression Holding is reinvesting its profits efficiently as evidenced by its exceptional growth which we discussed above.

Moreover, Burckhardt Compression Holding is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 54% of its profits over the next three years. Therefore, the company's future ROE is also not expected to change by much with analysts predicting an ROE of 29%.

Summary

Overall, we are quite pleased with Burckhardt Compression Holding's performance. Particularly, we like that the company is reinvesting heavily into its business, and at a high rate of return. Unsurprisingly, this has led to an impressive earnings growth. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're helping make it simple.

Find out whether Burckhardt Compression Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BCHN

Burckhardt Compression Holding

Burckhardt Compression Holding AG manufactures and sells reciprocating compressors worldwide.

Outstanding track record with excellent balance sheet and pays a dividend.