Stock Analysis

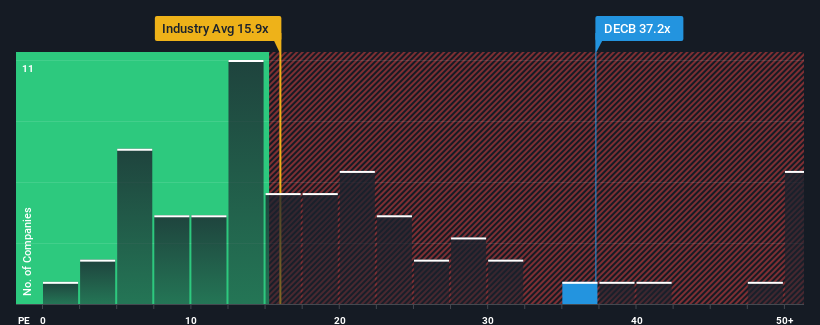

When close to half the companies in Belgium have price-to-earnings ratios (or "P/E's") below 15x, you may consider Deceuninck NV (EBR:DECB) as a stock to avoid entirely with its 37.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Deceuninck has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Deceuninck

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Deceuninck would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 58%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 61% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 64% each year as estimated by the three analysts watching the company. With the market only predicted to deliver 17% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Deceuninck's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Deceuninck maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Deceuninck, and understanding these should be part of your investment process.

If you're unsure about the strength of Deceuninck's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether Deceuninck is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About ENXTBR:DECB

Deceuninck

Deceuninck NV engages in the design, manufacture, recycling, and distribution of multi-material window, door, and building solutions in Europe, North America, Turkey, and internationally.

Flawless balance sheet with proven track record.