Stock Analysis

- Poland

- /

- Specialty Stores

- /

- WSE:APR

Investors Appear Satisfied With Auto Partner SA's (WSE:APR) Prospects

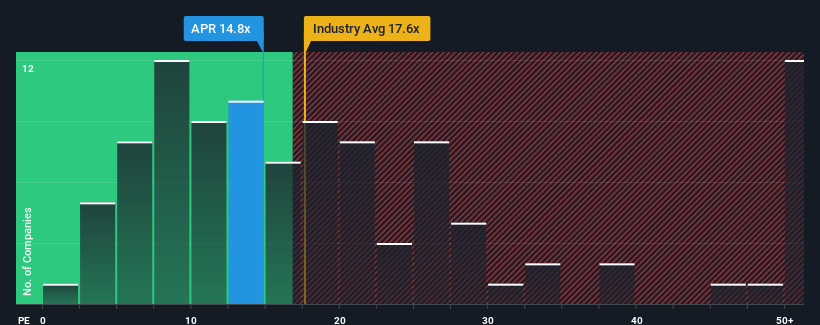

With a price-to-earnings (or "P/E") ratio of 14.8x Auto Partner SA (WSE:APR) may be sending bearish signals at the moment, given that almost half of all companies in Poland have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, Auto Partner has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Auto Partner

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Auto Partner would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 13% last year. This was backed up an excellent period prior to see EPS up by 132% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 19% per year during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 9.8% each year, which is noticeably less attractive.

With this information, we can see why Auto Partner is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Auto Partner's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Auto Partner's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Auto Partner with six simple checks.

You might be able to find a better investment than Auto Partner. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Auto Partner is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About WSE:APR

Auto Partner

Auto Partner SA sells spare parts for cars, light commercial vehicles, and motorcycles in Poland and internationally.

Flawless balance sheet and undervalued.