Stock Analysis

- Japan

- /

- Consumer Durables

- /

- TSE:8130

Investor Optimism Abounds Sangetsu Corporation (TSE:8130) But Growth Is Lacking

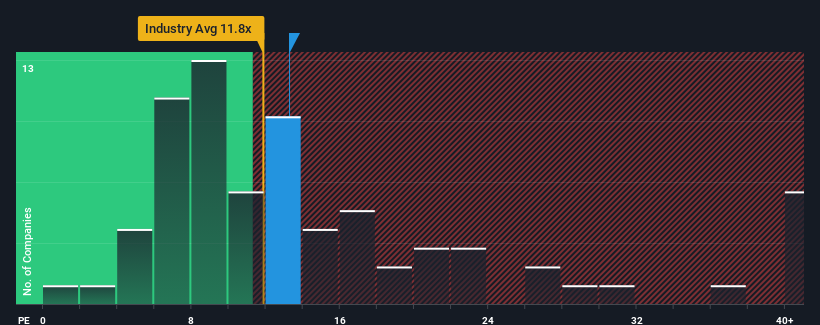

It's not a stretch to say that Sangetsu Corporation's (TSE:8130) price-to-earnings (or "P/E") ratio of 13.3x right now seems quite "middle-of-the-road" compared to the market in Japan, where the median P/E ratio is around 15x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Sangetsu as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for Sangetsu

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Sangetsu's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 91% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 3.8% during the coming year according to the lone analyst following the company. With the market predicted to deliver 11% growth , the company is positioned for a weaker earnings result.

With this information, we find it interesting that Sangetsu is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Sangetsu's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Sangetsu with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Sangetsu. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're helping make it simple.

Find out whether Sangetsu is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TSE:8130

Sangetsu

Sangetsu Corporation, together with its subsidiaries, engages in the planning, development, manufacture, sale, and installation of interior decorating products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.