Stock Analysis

- United Kingdom

- /

- Construction

- /

- LSE:KIE

Income Investors Should Know That Kier Group plc (LON:KIE) Goes Ex-Dividend Soon

Kier Group plc (LON:KIE) stock is about to trade ex-dividend in 4 days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase Kier Group's shares before the 18th of April in order to be eligible for the dividend, which will be paid on the 31st of May.

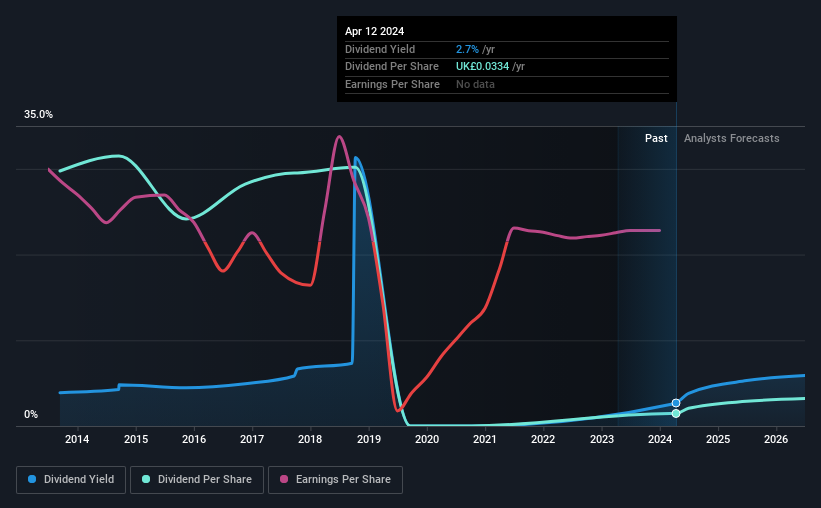

The company's next dividend payment will be UK£0.0167 per share. Last year, in total, the company distributed UK£0.033 to shareholders. Calculating the last year's worth of payments shows that Kier Group has a trailing yield of 2.7% on the current share price of UK£1.244. If you buy this business for its dividend, you should have an idea of whether Kier Group's dividend is reliable and sustainable. We need to see whether the dividend is covered by earnings and if it's growing.

See our latest analysis for Kier Group

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Kier Group paid out just 18% of its profit last year, which we think is conservatively low and leaves plenty of margin for unexpected circumstances.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Kier Group's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 37% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Kier Group's dividend payments per share have declined at 26% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Final Takeaway

Is Kier Group an attractive dividend stock, or better left on the shelf? Kier Group's earnings per share are down over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. Kier Group ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

While it's tempting to invest in Kier Group for the dividends alone, you should always be mindful of the risks involved. To help with this, we've discovered 2 warning signs for Kier Group that you should be aware of before investing in their shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Kier Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:KIE

Kier Group

Kier Group plc primarily engages in the construction business in the United Kingdom and internationally.

Reasonable growth potential with proven track record.