Stock Analysis

- Malta

- /

- Real Estate

- /

- MTSE:HLI

Hili Properties p.l.c.'s (MTSE:HLI) Business And Shares Still Trailing The Market

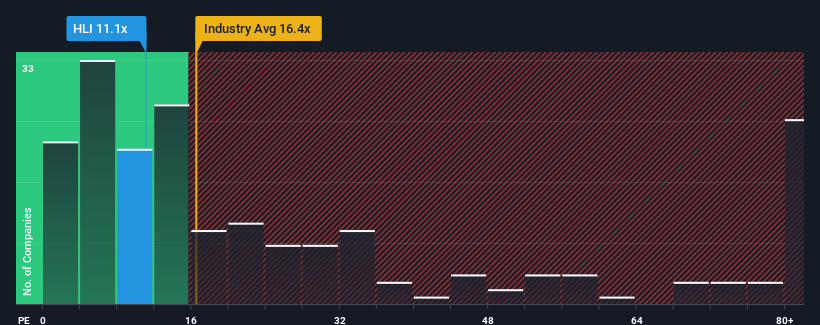

With a price-to-earnings (or "P/E") ratio of 11.1x Hili Properties p.l.c. (MTSE:HLI) may be sending bullish signals at the moment, given that almost half of all companies in Malta have P/E ratios greater than 15x and even P/E's higher than 20x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Hili Properties has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Hili Properties

What Are Growth Metrics Telling Us About The Low P/E?

Hili Properties' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered an exceptional 126% gain to the company's bottom line. Still, incredibly EPS has fallen 85% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 17% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Hili Properties' P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hili Properties maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Hili Properties (2 shouldn't be ignored) you should be aware of.

If these risks are making you reconsider your opinion on Hili Properties, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether Hili Properties is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About MTSE:HLI

Hili Properties

Hili Properties p.l.c., a property holding company, owns, and manages properties in Romania, Malta, Latvia, Lithuania, and Estonia.

Solid track record with mediocre balance sheet.