Stock Analysis

- New Zealand

- /

- Hospitality

- /

- NZSE:BFG

Here's Why Burger Fuel Group (NZSE:BFG) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Burger Fuel Group (NZSE:BFG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Burger Fuel Group with the means to add long-term value to shareholders.

Check out our latest analysis for Burger Fuel Group

How Quickly Is Burger Fuel Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Burger Fuel Group has grown EPS by 46% per year, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

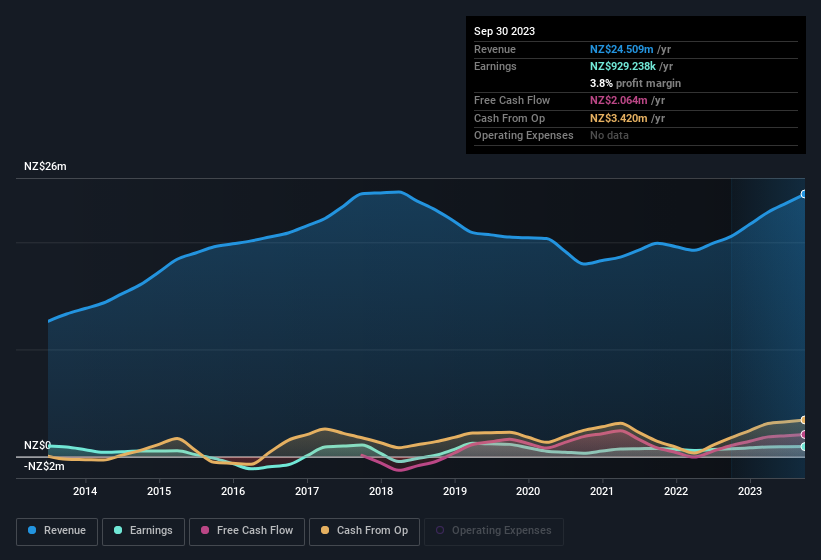

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Burger Fuel Group remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to NZ$25m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Burger Fuel Group isn't a huge company, given its market capitalisation of NZ$18m. That makes it extra important to check on its balance sheet strength.

Are Burger Fuel Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Burger Fuel Group shares, in the last year. Add in the fact that Christopher Mason, the company insider of the company, paid NZ$29k for shares at around NZ$0.30 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Burger Fuel Group will reveal that insiders own a significant piece of the pie. In fact, they own 66% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. Of course, Burger Fuel Group is a very small company, with a market cap of only NZ$18m. That means insiders only have NZ$12m worth of shares, despite the large proportional holding. That might not be a huge sum but it should be enough to keep insiders motivated!

Is Burger Fuel Group Worth Keeping An Eye On?

Burger Fuel Group's earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Burger Fuel Group deserves timely attention. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Burger Fuel Group , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Burger Fuel Group isn't the only one. You can see a a curated list of New Zealander companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're helping make it simple.

Find out whether Burger Fuel Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About NZSE:BFG

Burger Fuel Group

Burger Fuel Group Limited operates as a franchisor of gourmet burger and chicken restaurants in New Zealand and internationally.

Solid track record with excellent balance sheet.