Stock Analysis

- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A066980

Hansung Cleantech Co., Ltd. (KOSDAQ:066980) Might Not Be As Mispriced As It Looks After Plunging 26%

The Hansung Cleantech Co., Ltd. (KOSDAQ:066980) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop has obliterated the annual return, with the share price now down 9.5% over that longer period.

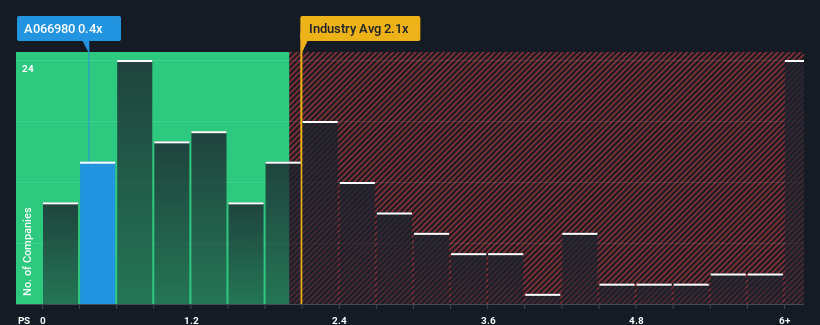

In spite of the heavy fall in price, considering around half the companies operating in Korea's Semiconductor industry have price-to-sales ratios (or "P/S") above 2.1x, you may still consider Hansung Cleantech as an solid investment opportunity with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Hansung Cleantech

How Has Hansung Cleantech Performed Recently?

Revenue has risen firmly for Hansung Cleantech recently, which is pleasing to see. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Hansung Cleantech, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hansung Cleantech's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Hansung Cleantech's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 81% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that Hansung Cleantech's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Hansung Cleantech's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Hansung Cleantech currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Hansung Cleantech (1 is a bit concerning!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Hansung Cleantech is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSDAQ:A066980

Hansung Cleantech

Hansung Cleantech Co., Ltd. engages in the environmental facility construction business.

Mediocre balance sheet and slightly overvalued.