Stock Analysis

- Taiwan

- /

- Basic Materials

- /

- TWSE:2504

Goldsun Building Materials Co., Ltd.'s (TWSE:2504) Price Is Right But Growth Is Lacking After Shares Rocket 30%

Goldsun Building Materials Co., Ltd. (TWSE:2504) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 73%.

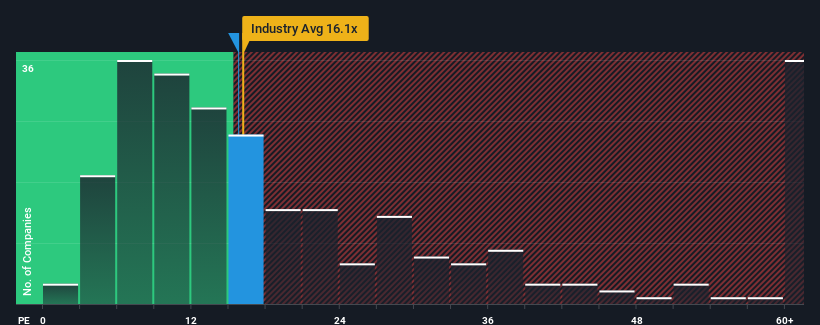

Even after such a large jump in price, Goldsun Building Materials may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 15.8x, since almost half of all companies in Taiwan have P/E ratios greater than 23x and even P/E's higher than 40x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Goldsun Building Materials has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Goldsun Building Materials

Is There Any Growth For Goldsun Building Materials?

There's an inherent assumption that a company should underperform the market for P/E ratios like Goldsun Building Materials' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's bottom line. Even so, admirably EPS has lifted 35% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 15% over the next year. Meanwhile, the rest of the market is forecast to expand by 26%, which is noticeably more attractive.

With this information, we can see why Goldsun Building Materials is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Goldsun Building Materials' P/E close to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Goldsun Building Materials' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Goldsun Building Materials (of which 1 shouldn't be ignored!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Goldsun Building Materials is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2504

Goldsun Building Materials

Goldsun Building Materials Co., Ltd., together with its subsidiaries, produces and sells premixed concrete cement, and calcium silicate board in Taiwan and Mainland China.

Flawless balance sheet and fair value.