Stock Analysis

Getting In Cheap On Coforge Limited (NSE:COFORGE) Might Be Difficult

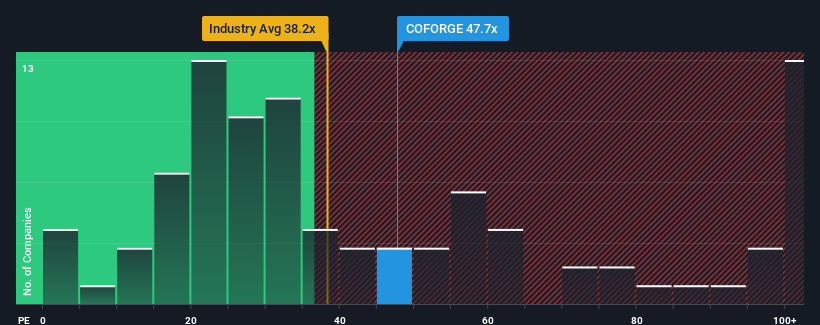

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 30x, you may consider Coforge Limited (NSE:COFORGE) as a stock to avoid entirely with its 47.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Coforge hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Coforge

Does Growth Match The High P/E?

In order to justify its P/E ratio, Coforge would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 12%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 59% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 28% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 20% per year, which is noticeably less attractive.

With this information, we can see why Coforge is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Coforge's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Coforge you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether Coforge is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:COFORGE

Coforge

Coforge Limited provides information technology (IT) and IT enabled services in India, the Americas, Europe, the Middle East and Africa, India, and the Asia Pacific.

High growth potential with excellent balance sheet and pays a dividend.