Stock Analysis

- Malaysia

- /

- Real Estate

- /

- KLSE:PLENITU

Further Upside For Plenitude Berhad (KLSE:PLENITU) Shares Could Introduce Price Risks After 28% Bounce

Plenitude Berhad (KLSE:PLENITU) shares have had a really impressive month, gaining 28% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 71%.

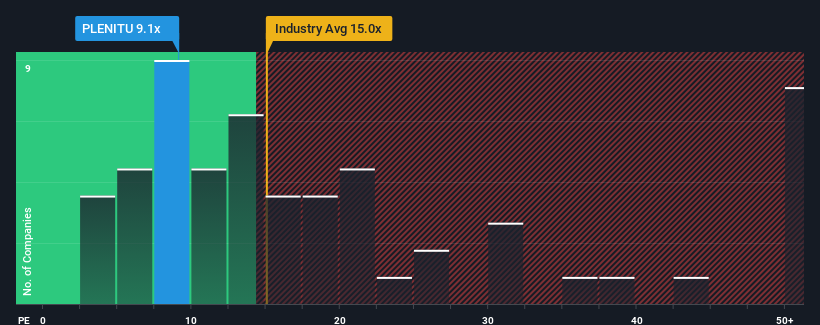

Although its price has surged higher, Plenitude Berhad may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 9.1x, since almost half of all companies in Malaysia have P/E ratios greater than 17x and even P/E's higher than 29x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Plenitude Berhad certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for Plenitude Berhad

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Plenitude Berhad's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 148% last year. The latest three year period has also seen an excellent 2,706% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 17% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Plenitude Berhad is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Plenitude Berhad's P/E?

Despite Plenitude Berhad's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Plenitude Berhad currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Plenitude Berhad with six simple checks.

You might be able to find a better investment than Plenitude Berhad. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Plenitude Berhad is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About KLSE:PLENITU

Plenitude Berhad

Plenitude Berhad, an investment holding company, engages in the development and sale of residential and commercial properties in Malaysia.

Solid track record with adequate balance sheet.