Stock Analysis

- United Kingdom

- /

- Basic Materials

- /

- LSE:FORT

Forterra (LON:FORT) Has Announced That Its Dividend Will Be Reduced To £0.02

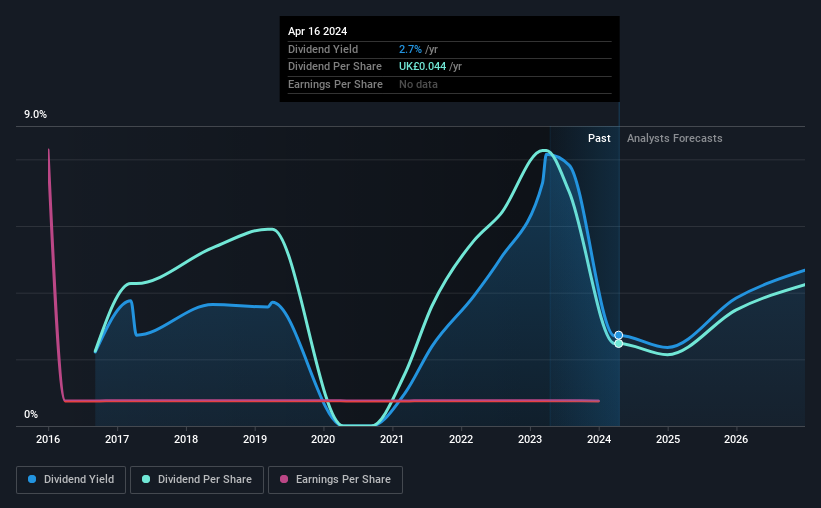

Forterra plc (LON:FORT) has announced that on 5th of July, it will be paying a dividend of£0.02, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 2.7%, which only provides a modest boost to overall returns.

View our latest analysis for Forterra

Forterra's Earnings Easily Cover The Distributions

If it is predictable over a long period, even low dividend yields can be attractive. Prior to this announcement, Forterra's dividend was making up a very large proportion of earnings, and the company was also not generating any cash flow to offset this. This is a pretty unsustainable practice, and could be risky if continued for the long term.

Over the next year, EPS is forecast to expand by 114.0%. If the dividend continues along recent trends, we estimate the payout ratio will be 36%, which is in the range that makes us comfortable with the sustainability of the dividend.

Forterra's Dividend Has Lacked Consistency

It's comforting to see that Forterra has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. Since 2016, the annual payment back then was £0.04, compared to the most recent full-year payment of £0.044. This means that it has been growing its distributions at 1.2% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Forterra's EPS has fallen by approximately 25% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

Forterra's Dividend Doesn't Look Sustainable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Case in point: We've spotted 4 warning signs for Forterra (of which 2 don't sit too well with us!) you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Forterra is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About LSE:FORT

Forterra

Forterra plc engages in the manufacture and sale of building products in the United Kingdom.

Reasonable growth potential with mediocre balance sheet.