Stock Analysis

Fondul Proprietatea SA (BVB:FP) will pay a dividend of RON0.06 on the 7th of June. This will take the dividend yield to an attractive 9.6%, providing a nice boost to shareholder returns.

Check out our latest analysis for Fondul Proprietatea

Fondul Proprietatea Might Find It Hard To Continue The Dividend

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though Fondul Proprietatea isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Looking forward, earnings per share could rise by 8.8% over the next year if the trend from the last few years continues. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

Dividend Volatility

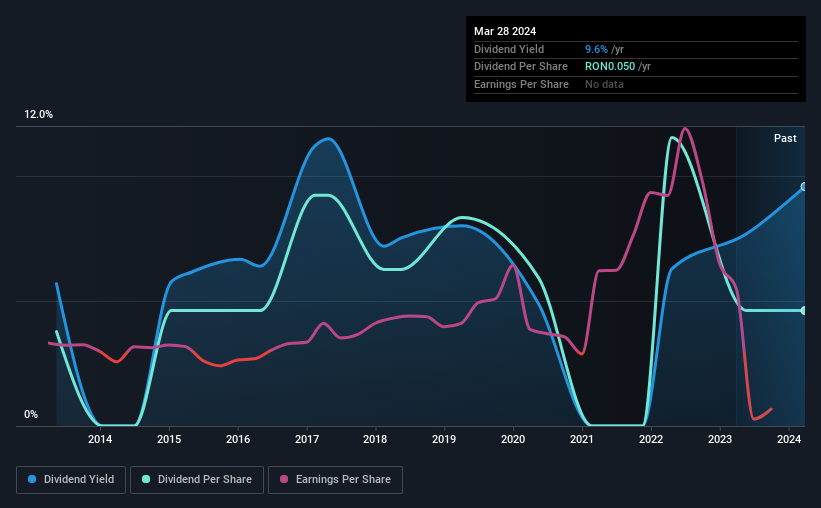

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of RON0.0409 in 2014 to the most recent total annual payment of RON0.05. This implies that the company grew its distributions at a yearly rate of about 2.0% over that duration. It's encouraging to see some dividend growth, but the dividend has been cut at least once, and the size of the cut would eliminate most of the growth anyway, which makes this less attractive as an income investment.

We Could See Fondul Proprietatea's Dividend Growing

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that Fondul Proprietatea has grown earnings per share at 8.8% per year over the past five years. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. As long as the company becomes profitable soon, it is on a trajectory that could see it being a solid dividend payer.

Our Thoughts On Fondul Proprietatea's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 3 warning signs for Fondul Proprietatea (2 can't be ignored!) that you should be aware of before investing. Is Fondul Proprietatea not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Fondul Proprietatea is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:FP

Fondul Proprietatea

Fondul Proprietatea SA is a publicly owned investment manager.

Flawless balance sheet average dividend payer.