Stock Analysis

- United Kingdom

- /

- Capital Markets

- /

- AIM:POLR

Fewer Investors Than Expected Jumping On Polar Capital Holdings Plc (LON:POLR)

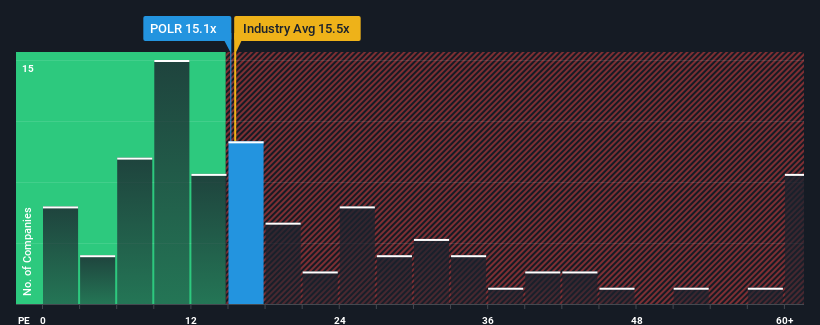

With a median price-to-earnings (or "P/E") ratio of close to 16x in the United Kingdom, you could be forgiven for feeling indifferent about Polar Capital Holdings Plc's (LON:POLR) P/E ratio of 15.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times haven't been advantageous for Polar Capital Holdings as its earnings have been falling quicker than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Polar Capital Holdings

How Is Polar Capital Holdings' Growth Trending?

The only time you'd be comfortable seeing a P/E like Polar Capital Holdings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 21% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 18% over the next year. With the market only predicted to deliver 16%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Polar Capital Holdings' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Polar Capital Holdings currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for Polar Capital Holdings you should be aware of.

You might be able to find a better investment than Polar Capital Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Polar Capital Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About AIM:POLR

Polar Capital Holdings

Polar Capital Holdings plc is a publicly owned investment manager.

Flawless balance sheet, good value and pays a dividend.