Stock Analysis

Exploring The Risks Of This Indian Company With A 3% Dividend Yield

Reviewed by Sasha Jovanovic

In the pursuit of steady income streams, many investors are drawn to dividend stocks in India. However, it's crucial to evaluate the sustainability of these dividends. A high payout ratio might appear appealing at first glance but could indicate potential financial difficulties for the company, making it a less reliable investment choice. In this article, we will explore two such companies—one that offers an attractive dividend yield and another that investors might consider avoiding due to its risky financial structure.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.56% | ★★★★★☆ |

| Balmer Lawrie Investments (BSE:532485) | 5.07% | ★★★★★☆ |

| Swaraj Engines (NSEI:SWARAJENG) | 3.85% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.45% | ★★★★★☆ |

| ITC (NSEI:ITC) | 3.05% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.04% | ★★★★★☆ |

| Gujarat Narmada Valley Fertilizers & Chemicals (NSEI:GNFC) | 4.39% | ★★★★★☆ |

| Ruchira Papers (NSEI:RUCHIRA) | 4.20% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.87% | ★★★★★☆ |

| Rashtriya Chemicals and Fertilizers (NSEI:RCF) | 3.80% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one to shun.

One To Reconsider

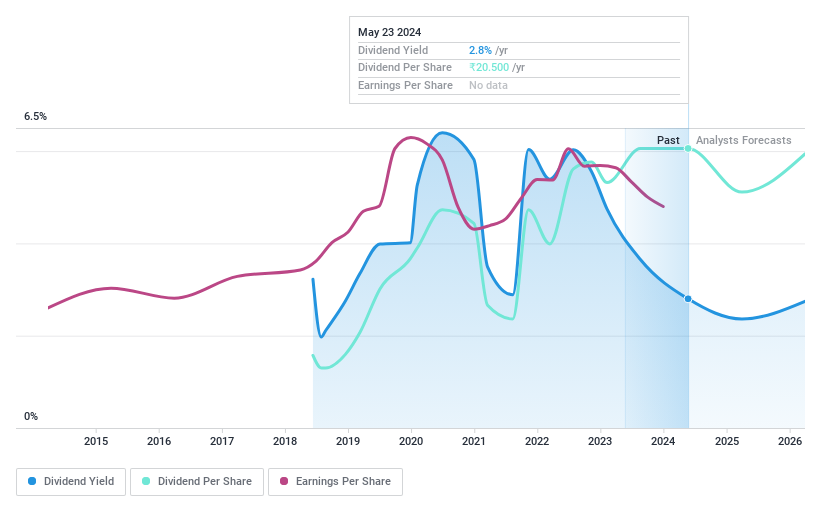

RITES (NSEI:RITES)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: RITES Limited operates in consultancy, engineering, and project management across various sectors including railways, highways, airports, ports, and renewable energy with a market capitalization of approximately ₹159.69 billion.

Operations: The company generates revenue through domestic consultancy (₹11.91 billion), turnkey construction projects within the country (₹8.74 billion), export sales (₹1.53 billion), domestic leasing (₹1.32 billion), and consultancy abroad (₹1.27 billion).

Dividend Yield: 3.1%

RITES Ltd. presents challenges for dividend investors due to its high payout ratios, with cash and earnings coverage at 110.5% and 99% respectively, indicating potential sustainability issues. Despite a dividend yield of 3.08%, which ranks well in the Indian market, the company's dividends are poorly supported by both earnings and cash flows, coupled with a history of unreliable payments over the past six years. Additionally, RITES has experienced significant share price volatility recently, further complicating its attractiveness as a stable dividend-paying stock.

Top Pick

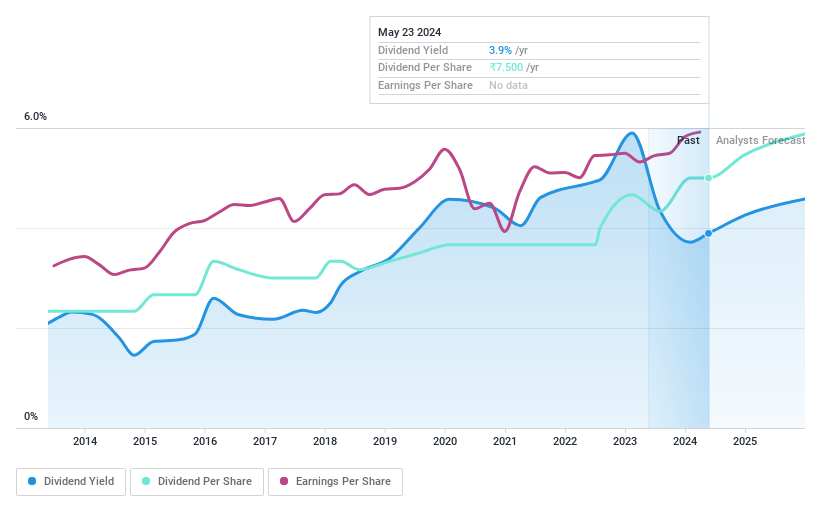

Castrol India (BSE:500870)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The company specializes in manufacturing and marketing automotive and industrial lubricants both domestically and internationally, with a market capitalization of approximately ₹208.51 billion.

Operations: The company generates its revenue primarily from the lubricants segment, totaling ₹50.75 billion.

Dividend Yield: 3.6%

Castrol India has shown a consistent dividend track record over the past decade, with dividends per share growing steadily. Despite a high payout ratio of 85.8%, its dividends are covered by earnings, though its cash payout ratio at 97.9% suggests potential pressure from free cash flow coverage. The company's recent financial performance indicates robust growth, with net income and revenue increasing significantly in the last quarter of 2023 compared to the previous year, supporting its dividend sustainability. However, the high cash payout ratio could pose challenges if not managed carefully.

Turning Ideas Into Actions

- Investigate our full lineup of 31 Top Dividend Stocks right here.

- Are you invested in any of these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion.

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Castrol India is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BSE:500870

Castrol India

Castrol India Limited manufactures and markets automotive and industrial lubricants in India and internationally.

Flawless balance sheet with solid track record and pays a dividend.