Stock Analysis

- Canada

- /

- Telecom Services and Carriers

- /

- TSX:TGO

Even With A 45% Surge, Cautious Investors Are Not Rewarding TeraGo Inc.'s (TSE:TGO) Performance Completely

TeraGo Inc. (TSE:TGO) shareholders would be excited to see that the share price has had a great month, posting a 45% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

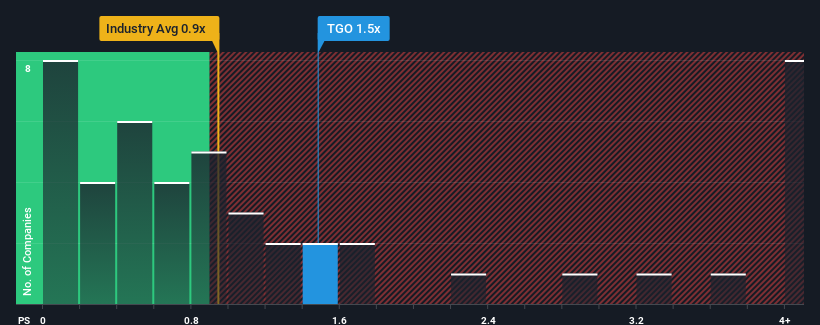

Although its price has surged higher, there still wouldn't be many who think TeraGo's price-to-sales (or "P/S") ratio of 1.5x is worth a mention when the median P/S in Canada's Telecom industry is similar at about 1x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for TeraGo

What Does TeraGo's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, TeraGo's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on TeraGo will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, TeraGo would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 5.7%. As a result, revenue from three years ago have also fallen 43% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 5.8% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 2.2%, which is noticeably less attractive.

In light of this, it's curious that TeraGo's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

TeraGo appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that TeraGo currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider and we've discovered 3 warning signs for TeraGo (1 is potentially serious!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on TeraGo, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're helping make it simple.

Find out whether TeraGo is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About TSX:TGO

TeraGo

TeraGo Inc., together with its subsidiaries, provides connectivity services for businesses primarily in Canada.

Weak fundamentals or lack of information.