Stock Analysis

- Sweden

- /

- Medical Equipment

- /

- OM:SEZI

Even after rising 12% this past week, Senzime (STO:SEZI) shareholders are still down 70% over the past three years

This week we saw the Senzime AB (publ) (STO:SEZI) share price climb by 12%. But that doesn't change the fact that the returns over the last three years have been disappointing. Regrettably, the share price slid 70% in that period. So it's good to see it climbing back up. Perhaps the company has turned over a new leaf.

On a more encouraging note the company has added kr89m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

See our latest analysis for Senzime

Senzime wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Senzime saw its revenue grow by 48% per year, compound. That is faster than most pre-profit companies. So why has the share priced crashed 19% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Ultimately, revenue growth doesn't amount to much if the business can't scale well. Unless the balance sheet is strong, the company might have to raise capital.

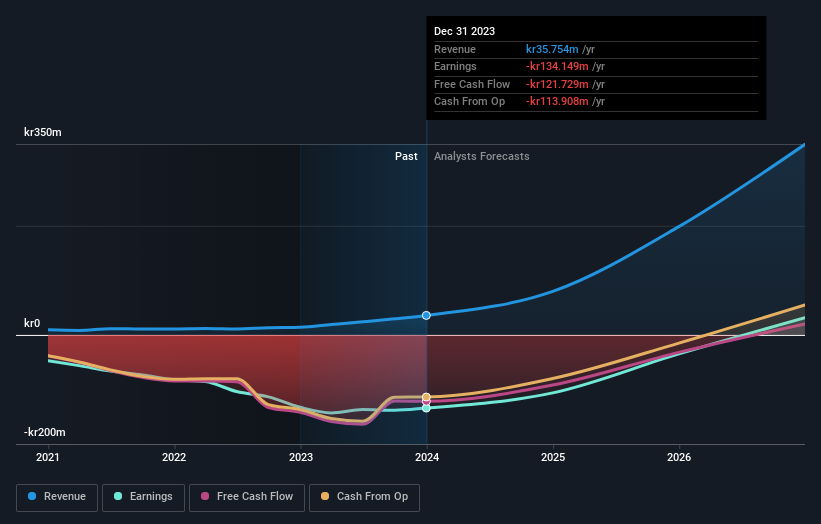

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Senzime in this interactive graph of future profit estimates.

A Different Perspective

Senzime shareholders have received returns of 14% over twelve months, which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 1.0% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Senzime has 3 warning signs we think you should be aware of.

We will like Senzime better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swedish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Senzime is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About OM:SEZI

Senzime

Senzime AB (publ), a medical device company, develops, manufactures, and markets algorithm-powered patient monitoring systems to increase patient safety during and after surgery in Europe and the United States.

High growth potential with excellent balance sheet.