Stock Analysis

- South Korea

- /

- Electronic Equipment and Components

- /

- KOSE:A007660

Earnings Tell The Story For ISU Petasys Co., Ltd. (KRX:007660) As Its Stock Soars 26%

Despite an already strong run, ISU Petasys Co., Ltd. (KRX:007660) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days were the cherry on top of the stock's 333% gain in the last year, which is nothing short of spectacular.

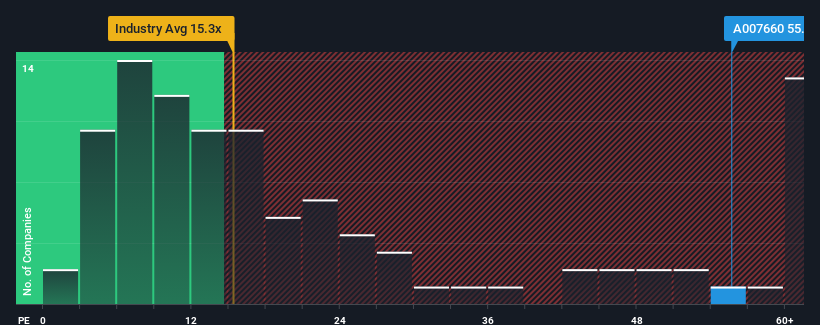

Since its price has surged higher, given close to half the companies in Korea have price-to-earnings ratios (or "P/E's") below 12x, you may consider ISU Petasys as a stock to avoid entirely with its 55.7x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

ISU Petasys has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for ISU Petasys

Is There Enough Growth For ISU Petasys?

ISU Petasys' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 52%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 76% over the next year. Meanwhile, the rest of the market is forecast to only expand by 27%, which is noticeably less attractive.

In light of this, it's understandable that ISU Petasys' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From ISU Petasys' P/E?

ISU Petasys' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of ISU Petasys' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for ISU Petasys (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you're unsure about the strength of ISU Petasys' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're helping make it simple.

Find out whether ISU Petasys is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About KOSE:A007660

ISU Petasys

ISU Petasys Co., Ltd. manufactures and sells printed circuit boards (PCBs) worldwide.

High growth potential with excellent balance sheet.