Stock Analysis

- Greece

- /

- Construction

- /

- ATSE:DOMIK

Domiki Kritis S.A.'s (ATH:DOMIK) 28% Jump Shows Its Popularity With Investors

The Domiki Kritis S.A. (ATH:DOMIK) share price has done very well over the last month, posting an excellent gain of 28%. The last 30 days were the cherry on top of the stock's 426% gain in the last year, which is nothing short of spectacular.

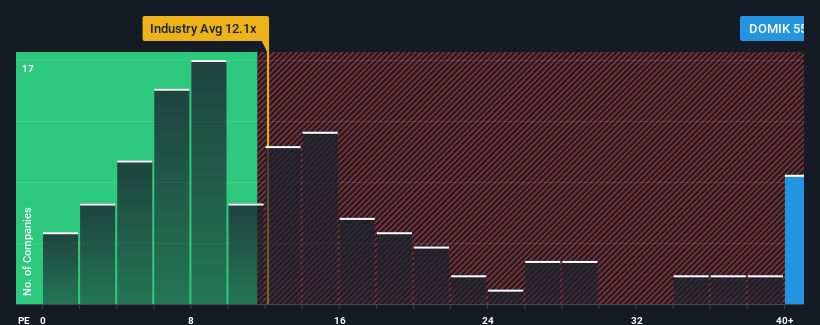

Following the firm bounce in price, Domiki Kritis may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 55.7x, since almost half of all companies in Greece have P/E ratios under 12x and even P/E's lower than 8x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's exceedingly strong of late, Domiki Kritis has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Domiki Kritis

How Is Domiki Kritis' Growth Trending?

Domiki Kritis' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 31%. The latest three year period has also seen an excellent 107% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 14% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Domiki Kritis is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

Domiki Kritis' P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Domiki Kritis maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Domiki Kritis that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're helping make it simple.

Find out whether Domiki Kritis is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:DOMIK

Domiki Kritis

Domiki Kritis S.A. primarily engages in the construction of heavy infrastructure projects for public and private sectors in Greece.

Excellent balance sheet with acceptable track record.