Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:DAE

Does Dätwyler Holding (VTX:DAE) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Dätwyler Holding AG (VTX:DAE) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Dätwyler Holding

What Is Dätwyler Holding's Debt?

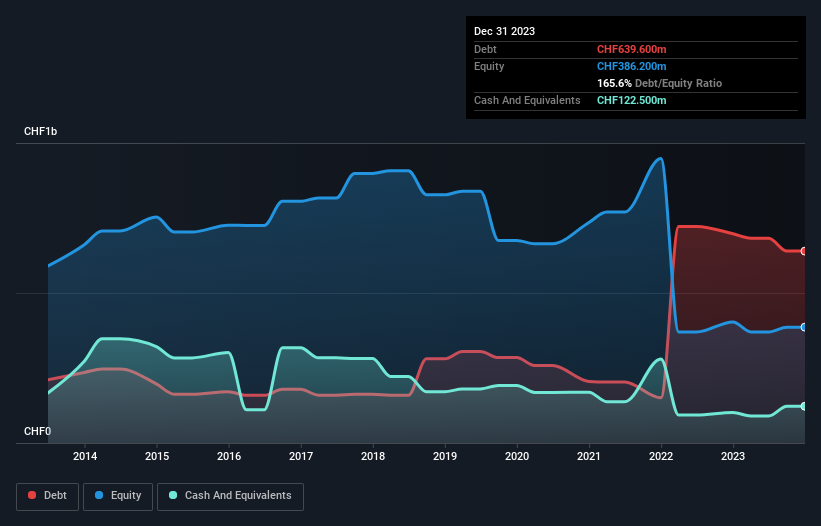

As you can see below, Dätwyler Holding had CHF639.6m of debt at December 2023, down from CHF697.4m a year prior. However, because it has a cash reserve of CHF122.5m, its net debt is less, at about CHF517.1m.

How Strong Is Dätwyler Holding's Balance Sheet?

The latest balance sheet data shows that Dätwyler Holding had liabilities of CHF314.8m due within a year, and liabilities of CHF499.8m falling due after that. Offsetting this, it had CHF122.5m in cash and CHF243.4m in receivables that were due within 12 months. So it has liabilities totalling CHF448.7m more than its cash and near-term receivables, combined.

Given Dätwyler Holding has a market capitalization of CHF2.93b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Dätwyler Holding has net debt to EBITDA of 2.7 suggesting it uses a fair bit of leverage to boost returns. But the high interest coverage of 8.7 suggests it can easily service that debt. Unfortunately, Dätwyler Holding's EBIT flopped 20% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Dätwyler Holding's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, Dätwyler Holding recorded free cash flow worth 53% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Dätwyler Holding's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example, its interest cover is relatively strong. We think that Dätwyler Holding's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Dätwyler Holding is showing 2 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're helping make it simple.

Find out whether Dätwyler Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Simply Wall St

About SWX:DAE

Dätwyler Holding

Dätwyler Holding AG engages in the production and sale of elastomer components for health care, mobility, connectors, general, and food and beverage industries in Europe, North America, South America, Australia, and Asia.

High growth potential with adequate balance sheet.