Stock Analysis

- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6230

Despite the downward trend in earnings at Nidec Chaun-Choung Technology (TWSE:6230) the stock swells 12%, bringing one-year gains to 21%

We believe investing is smart because history shows that stock markets go higher in the long term. But if you choose that path, you're going to buy some stocks that fall short of the market. For example, the Nidec Chaun-Choung Technology Corporation (TWSE:6230), share price is up over the last year, but its gain of 21% trails the market return. In contrast, the longer term returns are negative, since the share price is 4.0% lower than it was three years ago.

Since it's been a strong week for Nidec Chaun-Choung Technology shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Nidec Chaun-Choung Technology

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

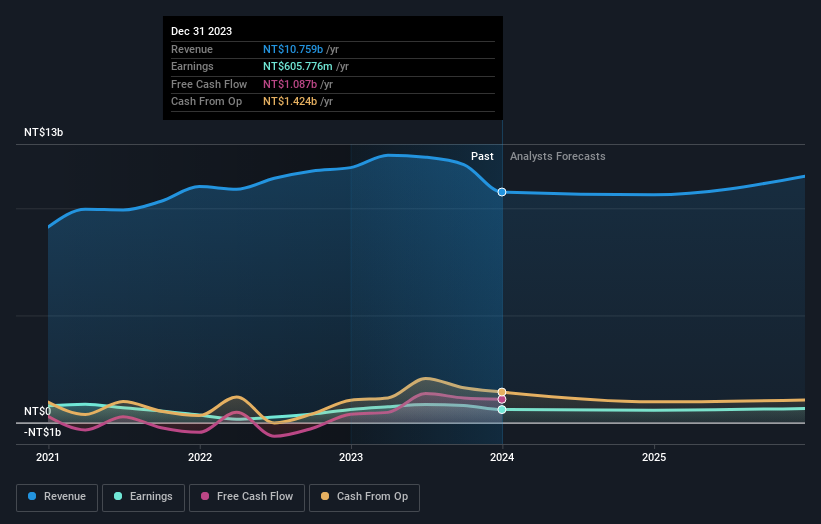

Over the last twelve months, Nidec Chaun-Choung Technology actually shrank its EPS by 1.2%.

The mild decline in EPS may be a result of the fact that the company is more focused on other aspects of the business, right now. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 0.5% dividend yield is doing much to support the share price. Nidec Chaun-Choung Technology's revenue actually dropped 9.6% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Nidec Chaun-Choung Technology's financial health with this free report on its balance sheet.

A Different Perspective

Nidec Chaun-Choung Technology shareholders are up 21% for the year (even including dividends). But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 4% per year over five year. It is possible that returns will improve along with the business fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Nidec Chaun-Choung Technology has 1 warning sign we think you should be aware of.

We will like Nidec Chaun-Choung Technology better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Nidec Chaun-Choung Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6230

Nidec Chaun-Choung Technology

Nidec Chaun-Choung Technology Corporation processes, manufactures, and trades heat dissipation components and thermal management products in Taiwan and internationally.

Excellent balance sheet and slightly overvalued.