Stock Analysis

- Hungary

- /

- Real Estate

- /

- BUSE:BIF

Despite the downward trend in earnings at Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt (BUSE:BIF) the stock rallies 12%, bringing one-year gains to 203%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt. (BUSE:BIF) share price has soared 167% in the last 1 year. Most would be very happy with that, especially in just one year! In more good news, the share price has risen 14% in thirty days. It is also impressive that the stock is up 106% over three years, adding to the sense that it is a real winner.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

See our latest analysis for Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt actually shrank its EPS by 4.2%.

Sometimes companies will sacrifice EPS in the short term for longer term gains; and in that case we may be able to find other positives. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We note that the most recent dividend payment is higher than the payment a year ago, so that may have assisted the share price. It could be that the company is reaching maturity and dividend investors are buying for the yield, pushing the price up in the process. Though we must add that the revenue growth of 85% year on year would have helped paint a pretty picture.

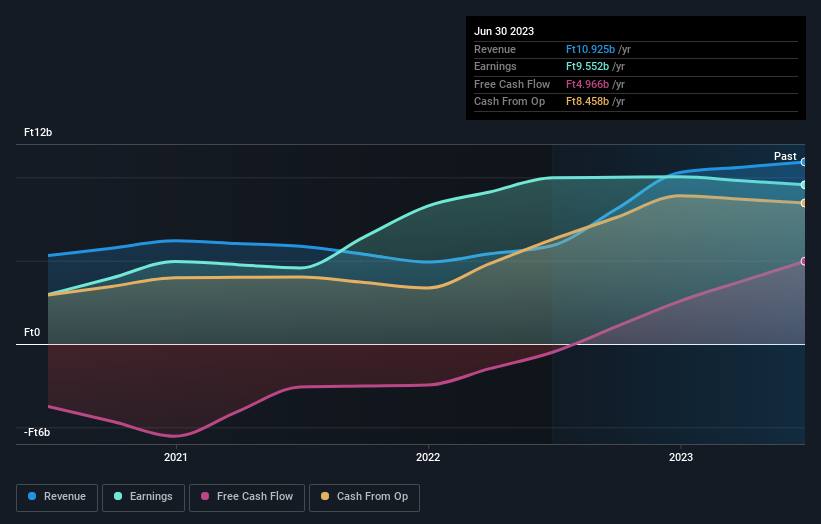

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt's financial health with this free report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt, it has a TSR of 203% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt shareholders have received a total shareholder return of 203% over the last year. Of course, that includes the dividend. That's better than the annualised return of 22% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt (1 makes us a bit uncomfortable) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hungarian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUSE:BIF

Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt

Budapesti Ingatlan Hasznosítási és Fejlesztési Nyrt.

Questionable track record with imperfect balance sheet.