Stock Analysis

Atria Oyj's (HEL:ATRAV) dividend is being reduced from last year's payment covering the same period to €0.60 on the 3rd of May. Despite the cut, the dividend yield of 2.9% will still be comparable to other companies in the industry.

View our latest analysis for Atria Oyj

Atria Oyj's Earnings Easily Cover The Distributions

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Even though Atria Oyj is not generating a profit, it is still paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

The next 12 months could see EPS growing very rapidly. If the dividend continues along recent trends, we estimate the payout ratio could reach 82%, which is on the higher side, but certainly feasible.

Dividend Volatility

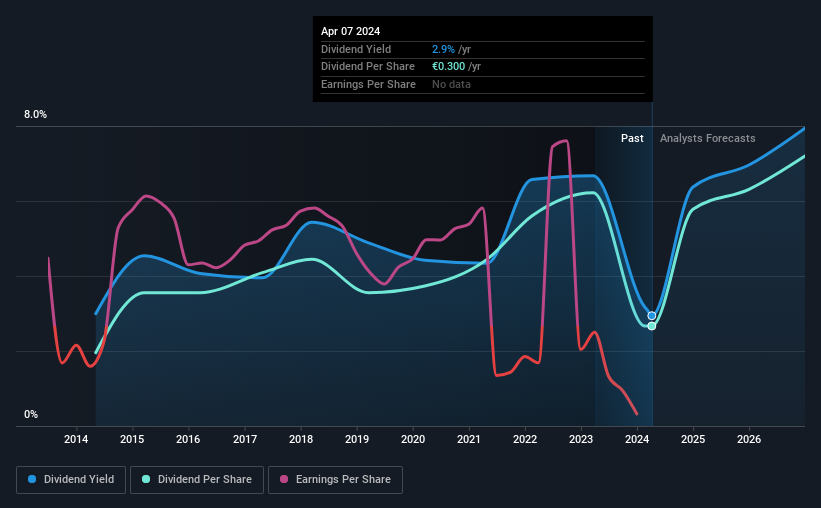

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of €0.22 in 2014 to the most recent total annual payment of €0.30. This means that it has been growing its distributions at 3.2% per annum over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Atria Oyj's earnings per share has shrunk at 31% a year over the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

We're Not Big Fans Of Atria Oyj's Dividend

To sum up, we don't like when dividends are cut, but in this case the dividend may have been too high to begin with. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 2 warning signs for Atria Oyj you should be aware of, and 1 of them can't be ignored. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Atria Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ATRAV

Atria Oyj

Atria Oyj, together with its subsidiaries, produces and markets meat and food products in Finland, Sweden, Denmark, Estonia, and Russia.

Undervalued with moderate growth potential.