Stock Analysis

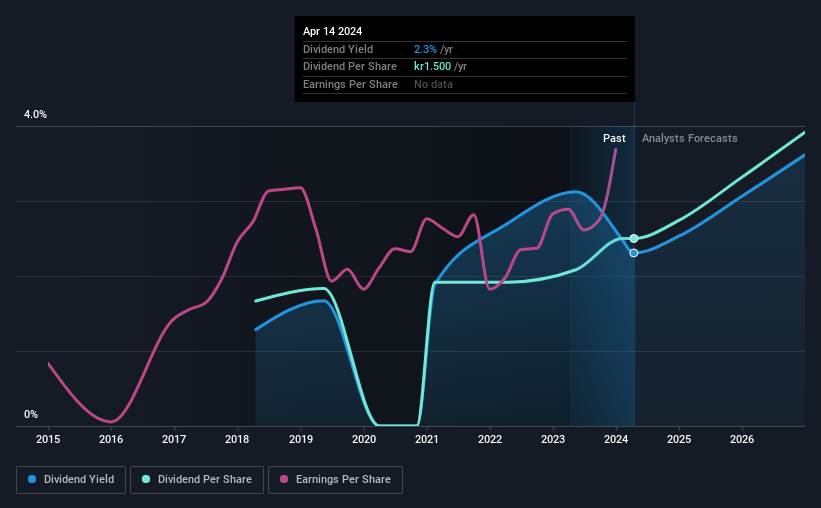

Ambea AB (publ)'s (STO:AMBEA) dividend will be increasing from last year's payment of the same period to SEK1.50 on 22nd of May. This will take the dividend yield to an attractive 2.3%, providing a nice boost to shareholder returns.

Check out our latest analysis for Ambea

Ambea's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Ambea was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 63.2%. If the dividend continues along recent trends, we estimate the payout ratio will be 19%, which is in the range that makes us comfortable with the sustainability of the dividend.

Ambea's Dividend Has Lacked Consistency

It's comforting to see that Ambea has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. The dividend has gone from an annual total of SEK1.00 in 2018 to the most recent total annual payment of SEK1.50. This means that it has been growing its distributions at 7.0% per annum over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Dividend Growth May Be Hard To Achieve

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Earnings has been rising at 3.1% per annum over the last five years, which admittedly is a bit slow. While growth may be thin on the ground, Ambea could always pay out a higher proportion of earnings to increase shareholder returns.

Our Thoughts On Ambea's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, Ambea has 2 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're helping make it simple.

Find out whether Ambea is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OM:AMBEA

Ambea

Ambea AB (publ) provides elderly care, disability care, and psychosocial support for the elderly and people with disabilities primarily in Sweden, Norway, and Denmark.

Solid track record and good value.