Stock Analysis

- Australia

- /

- Metals and Mining

- /

- ASX:A1M

AIC Mines Limited (ASX:A1M) Surges 33% Yet Its Low P/S Is No Reason For Excitement

AIC Mines Limited (ASX:A1M) shares have had a really impressive month, gaining 33% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.6% in the last twelve months.

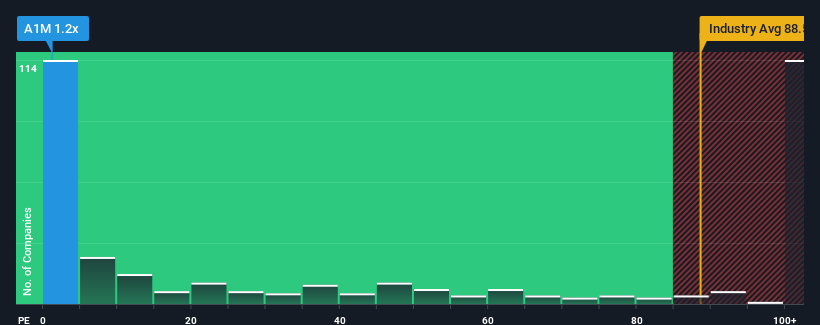

Although its price has surged higher, AIC Mines may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.2x, considering almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 88.5x and even P/S higher than 546x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for AIC Mines

What Does AIC Mines' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, AIC Mines has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on AIC Mines will help you uncover what's on the horizon.How Is AIC Mines' Revenue Growth Trending?

AIC Mines' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 138% each year growth forecast for the broader industry.

With this in consideration, its clear as to why AIC Mines' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in AIC Mines have risen appreciably however, its P/S is still subdued. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of AIC Mines' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 3 warning signs for AIC Mines (1 is potentially serious!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're helping make it simple.

Find out whether AIC Mines is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:A1M

AIC Mines

AIC Mines Limited explores for, develops, and acquires gold and copper deposits in Australia.

High growth potential with excellent balance sheet.