Stock Analysis

- Romania

- /

- Aerospace & Defense

- /

- BVB:ARS

Aerostar S.A.'s (BVB:ARS) Business Is Yet to Catch Up With Its Share Price

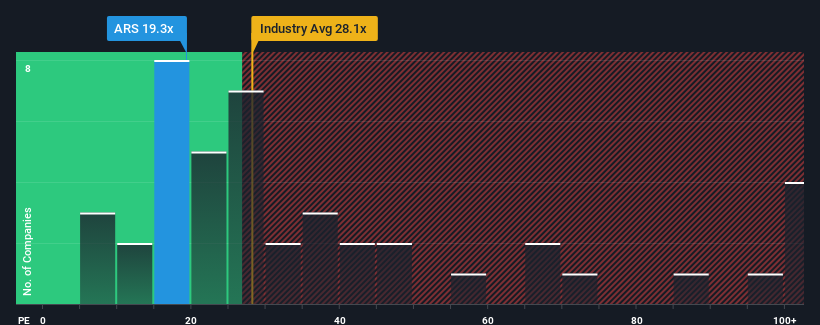

With a price-to-earnings (or "P/E") ratio of 19.3x Aerostar S.A. (BVB:ARS) may be sending very bearish signals at the moment, given that almost half of all companies in Romania have P/E ratios under 11x and even P/E's lower than 7x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For example, consider that Aerostar's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Aerostar

How Is Aerostar's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Aerostar's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.5%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 10% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Aerostar is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Aerostar revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Aerostar that you should be aware of.

You might be able to find a better investment than Aerostar. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're helping make it simple.

Find out whether Aerostar is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BVB:ARS

Aerostar

Aerostar S.A. engages in the manufacture, integration, upgrade, and maintenance of aviation and defense systems for the civil aviation industry in Romania and internationally.

Flawless balance sheet with questionable track record.