As global markets navigate a complex landscape marked by interest rate adjustments and tariff developments, investors are keenly observing the performance of major indices like the Nasdaq Composite, which recently set a fresh all-time high. Amidst these fluctuations, identifying undervalued stocks can be an effective strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiaocaiyuan International Holding (SEHK:999) | HK$10.22 | HK$20.38 | 49.8% |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥155.71 | CN¥310.78 | 49.9% |

| Sparebank 68° Nord (OB:SB68) | NOK175.06 | NOK348.25 | 49.7% |

| Kuros Biosciences (SWX:KURN) | CHF27.46 | CHF54.72 | 49.8% |

| InPost (ENXTAM:INPST) | €13.38 | €26.51 | 49.5% |

| IDI (ENXTPA:IDIP) | €79.40 | €157.71 | 49.7% |

| EROAD (NZSE:ERD) | NZ$2.31 | NZ$4.60 | 49.8% |

| Echo Investment (WSE:ECH) | PLN5.38 | PLN10.71 | 49.7% |

| Atea (OB:ATEA) | NOK141.20 | NOK281.16 | 49.8% |

| Andes Technology (TWSE:6533) | NT$274.00 | NT$543.72 | 49.6% |

Let's dive into some prime choices out of the screener.

ACM Research (Shanghai) (SHSE:688082)

Overview: ACM Research (Shanghai), Inc. focuses on the research, development, production, and sale of semiconductor equipment both in China and internationally, with a market cap of CN¥51 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, generating CN¥6.48 billion.

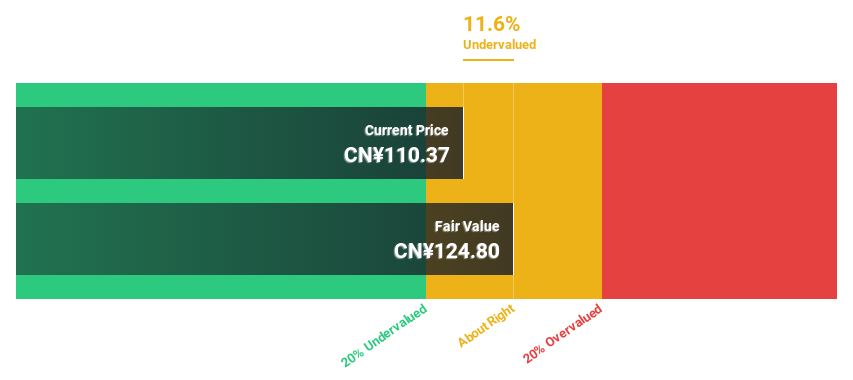

Estimated Discount To Fair Value: 19.8%

ACM Research (Shanghai) is trading at a good value, 19.8% below its estimated fair value of CN¥146.56, with strong earnings growth of 53.8% over the past year and forecasted annual profit growth exceeding market expectations at 24.4%. Despite low return on equity forecasts and a dividend not well covered by free cash flows, recent earnings reports show substantial revenue and net income increases, underscoring its potential as an undervalued stock based on cash flows.

- Our growth report here indicates ACM Research (Shanghai) may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of ACM Research (Shanghai) stock in this financial health report.

Kuraray (TSE:3405)

Overview: Kuraray Co., Ltd. is involved in the global production and sale of resins, chemicals, fibers, activated carbon, and high-performance membranes and systems, with a market cap of approximately ¥544.68 billion.

Operations: The company's revenue segments include Vinyl Acetate at ¥408.95 billion, Functional Materials at ¥203.36 billion, Isoprene at ¥78.77 billion, Fibers and Textiles at ¥61.19 billion, and Trading at ¥69.30 billion.

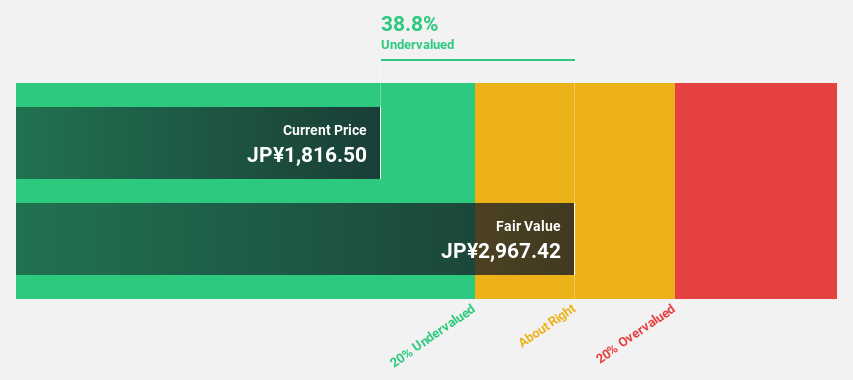

Estimated Discount To Fair Value: 43.6%

Kuraray is trading at ¥1,747, significantly below its estimated fair value of ¥3,098.28. Despite a low forecasted return on equity and profit margins dropping from 6.3% to 1.9%, the company's earnings are expected to grow substantially at 29.4% annually, outpacing the Japanese market's growth rate of 8.1%. Recent share buybacks further indicate confidence in its valuation and potential as an undervalued stock based on cash flows.

- Our comprehensive growth report raises the possibility that Kuraray is poised for substantial financial growth.

- Get an in-depth perspective on Kuraray's balance sheet by reading our health report here.

Daiichi Sankyo Company (TSE:4568)

Overview: Daiichi Sankyo Company, Limited is a pharmaceutical manufacturer and seller operating in Japan, North America, Europe, and internationally with a market cap of ¥6.61 trillion.

Operations: The company generates revenue primarily from its Pharmaceutical Operation segment, which amounts to ¥1.92 trillion.

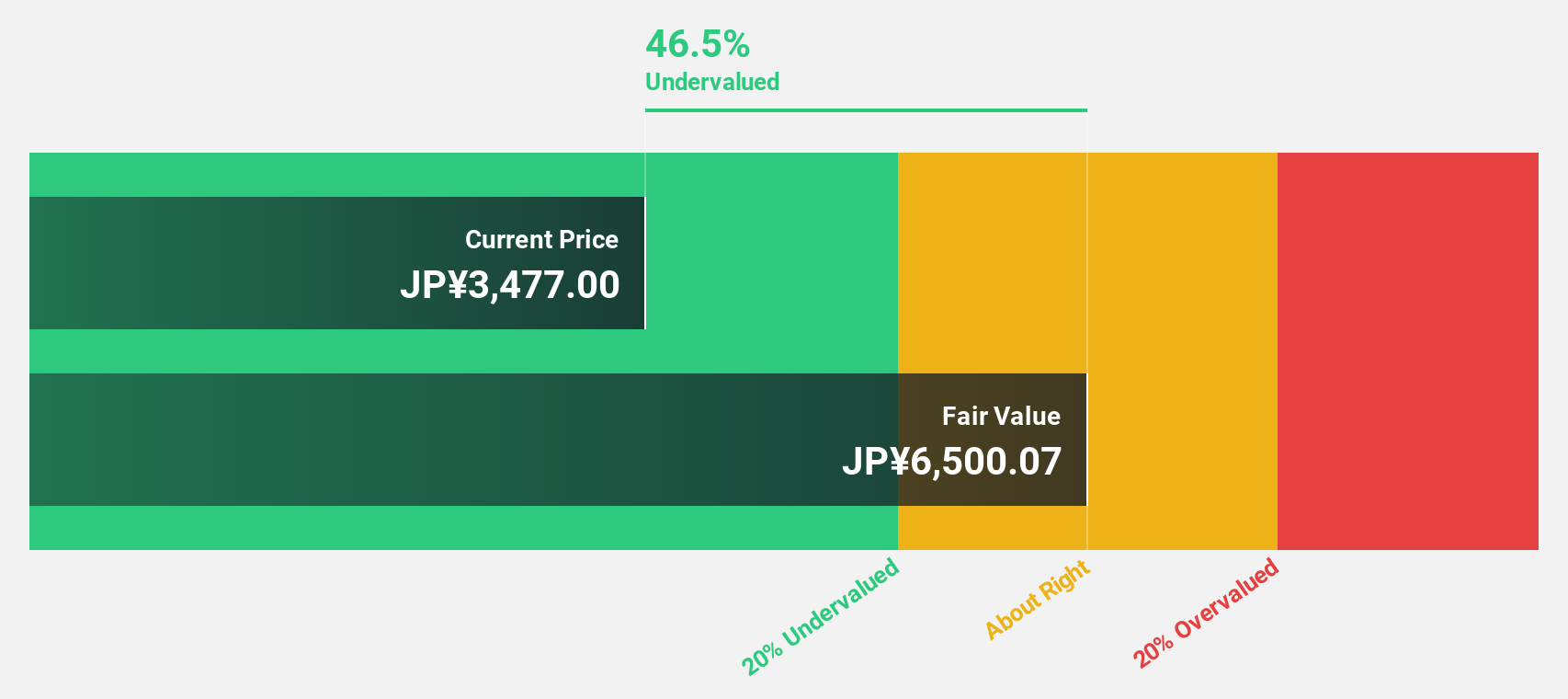

Estimated Discount To Fair Value: 41%

Daiichi Sankyo is trading at ¥3,671, considerably below its fair value estimate of ¥6,226.62, based on discounted cash flow analysis. Despite a dividend yield of 2.12% not fully covered by free cash flows and high non-cash earnings levels, the company's earnings are projected to grow at 12.52% annually, surpassing the Japanese market's growth rate of 8.1%. Recent product developments in oncology may enhance future revenue streams.

- Our expertly prepared growth report on Daiichi Sankyo Company implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Daiichi Sankyo Company's balance sheet health report.

Seize The Opportunity

- Navigate through the entire inventory of 504 Undervalued Global Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4568

Daiichi Sankyo Company

Manufactures and sells pharmaceutical products in Japan, the United States, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives