- Norway

- /

- Oil and Gas

- /

- OB:ALNG

3 European Penny Stocks With Market Caps Over €40M

Reviewed by Simply Wall St

As the European markets see a boost from slowed inflation and eased monetary policy by the European Central Bank, investors are exploring diverse opportunities across various sectors. Penny stocks, despite their somewhat outdated name, continue to be a significant area of interest for those looking to invest in smaller or newer companies. With solid financial foundations, these stocks can offer surprising value and potential for growth.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| KebNi (OM:KEBNI B) | SEK1.86 | SEK504.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.67 | SEK275.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.97 | €62.64M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.68 | €17.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN10.78M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.41 | SEK2.31B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:MLERO) | €3.26 | €9.49M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.195 | €303.05M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.952 | €31.88M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 448 stocks from our European Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pininfarina (BIT:PINF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pininfarina S.p.A. operates in the design, engineering, and sales of spare parts and prototypes across Italy, Germany, China, and the United States with a market cap of €62.14 million.

Operations: The company's revenue is primarily derived from its Style segment at €89.67 million and its Engineering segment at €9.76 million.

Market Cap: €62.14M

Pininfarina S.p.A. recently reported a net loss of €2.95 million for Q1 2025, with revenues declining to €19.12 million from €22.53 million year-on-year, indicating challenges in maintaining sales momentum. The company has become profitable over the past year but was impacted by a significant one-off gain of €2.1 million in its financial results up to September 2024, raising questions about the sustainability of earnings quality. While Pininfarina's debt levels are manageable with more cash than total debt and short-term assets covering liabilities, its return on equity remains low at 0.6%.

- Unlock comprehensive insights into our analysis of Pininfarina stock in this financial health report.

- Learn about Pininfarina's historical performance here.

Awilco LNG (OB:ALNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Awilco LNG ASA, based in Norway, owns and operates liquefied natural gas (LNG) vessels and has a market capitalization of NOK364.51 million.

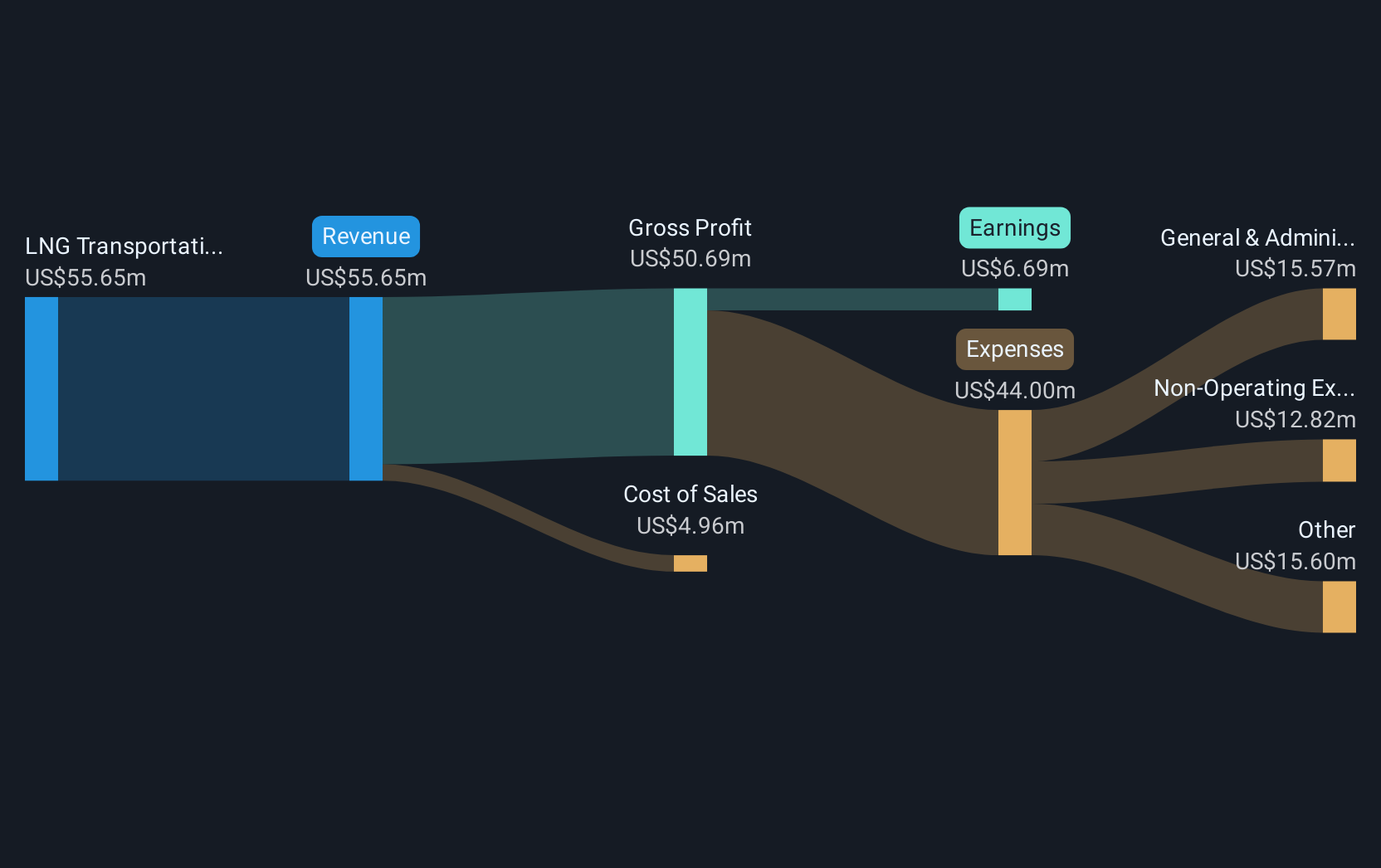

Operations: The company's revenue is primarily generated from LNG transportation, amounting to $55.65 million.

Market Cap: NOK364.51M

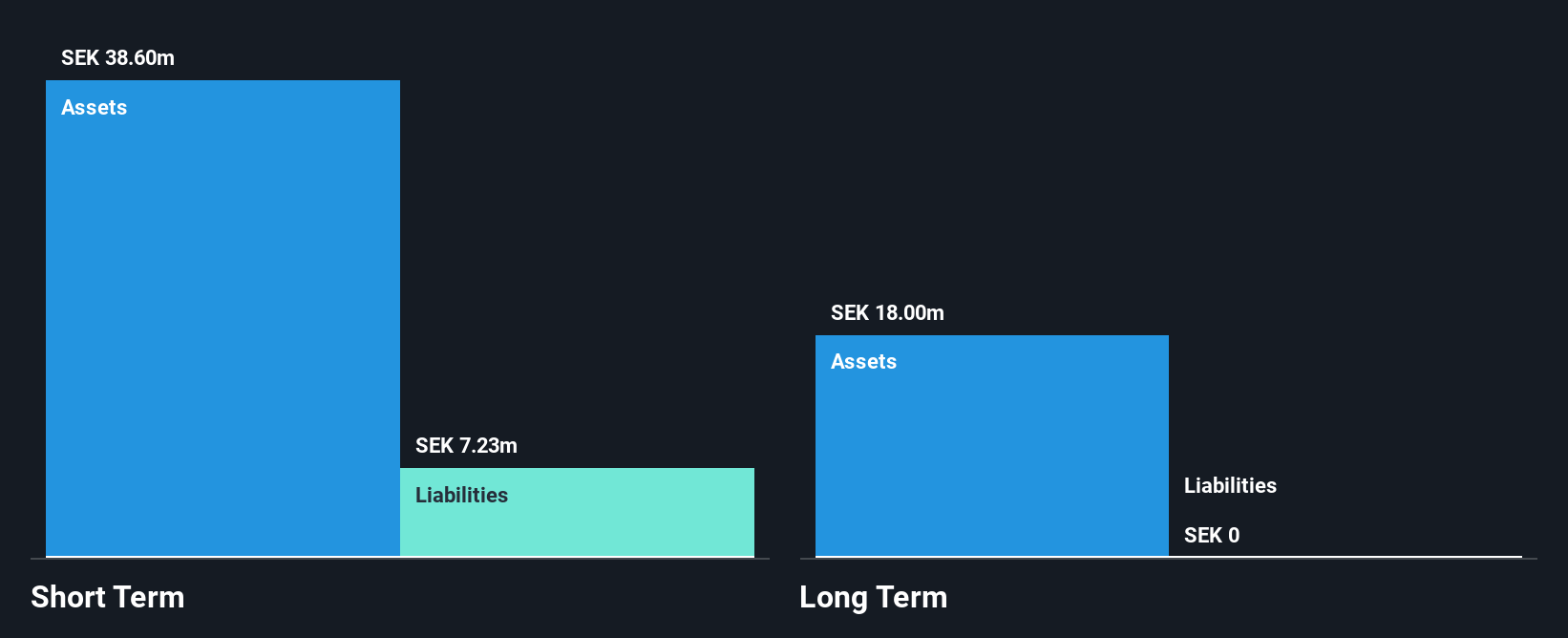

Awilco LNG ASA, with a market capitalization of NOK364.51 million, has faced challenges recently, reporting a net loss of US$3.25 million for Q1 2025 despite having no debt and seasoned management. The company's short-term assets exceed its liabilities, but long-term liabilities remain uncovered. Negative earnings growth and declining profit margins to 12% from last year's 44.3% highlight operational difficulties amid volatile share prices and high weekly volatility compared to peers. Although trading below estimated fair value by over 80%, earnings are forecasted to decline significantly in the coming years, raising concerns about future profitability prospects.

- Dive into the specifics of Awilco LNG here with our thorough balance sheet health report.

- Examine Awilco LNG's earnings growth report to understand how analysts expect it to perform.

Kancera (OM:KAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kancera AB (publ) is a Swedish company that develops drugs for inflammatory diseases and cancer, with a market cap of SEK135.73 million.

Operations: Kancera AB (publ) currently does not report any specific revenue segments.

Market Cap: SEK135.73M

Kancera AB, with a market cap of SEK135.73 million, remains pre-revenue and unprofitable, facing a net loss of SEK12.93 million in Q1 2025. The company is debt-free but has less than a year of cash runway and high share price volatility compared to Swedish peers. Recent strategic moves include a letter of intent with Recardio Inc., aiming to create a cardiovascular-focused entity by licensing KAND567 and KAND145, though funding challenges persist amid the macro environment. The completion of the KANDOVA study in ovarian cancer marks progress in its clinical pipeline as it awaits top-line results later this year.

- Jump into the full analysis health report here for a deeper understanding of Kancera.

- Understand Kancera's earnings outlook by examining our growth report.

Seize The Opportunity

- Click through to start exploring the rest of the 445 European Penny Stocks now.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ALNG

Awilco LNG

Owns and operates liquefied natural gas (LNG) vessels in Norway.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives