3 Asian Stocks Estimated To Be Trading At Discounts Up To 30.4%

Reviewed by Simply Wall St

As Asian markets experience a resurgence, with Japan's stock indices climbing sharply and China's technology shares gaining momentum, investors are increasingly looking for opportunities within the region. In this context, identifying undervalued stocks becomes crucial as these may offer potential value in a market environment characterized by political changes and economic adjustments.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥37.42 | CN¥74.69 | 49.9% |

| Teikoku Sen-i (TSE:3302) | ¥3390.00 | ¥6726.75 | 49.6% |

| TaewoongLtd (KOSDAQ:A044490) | ₩31400.00 | ₩61932.32 | 49.3% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.42 | CN¥26.39 | 49.2% |

| NexTone (TSE:7094) | ¥2266.00 | ¥4509.38 | 49.7% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.197 | NZ$0.39 | 49% |

| COVER (TSE:5253) | ¥1867.00 | ¥3693.14 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.22 | CN¥94.98 | 48.2% |

| Andes Technology (TWSE:6533) | NT$268.00 | NT$531.36 | 49.6% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥27.58 | CN¥54.10 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

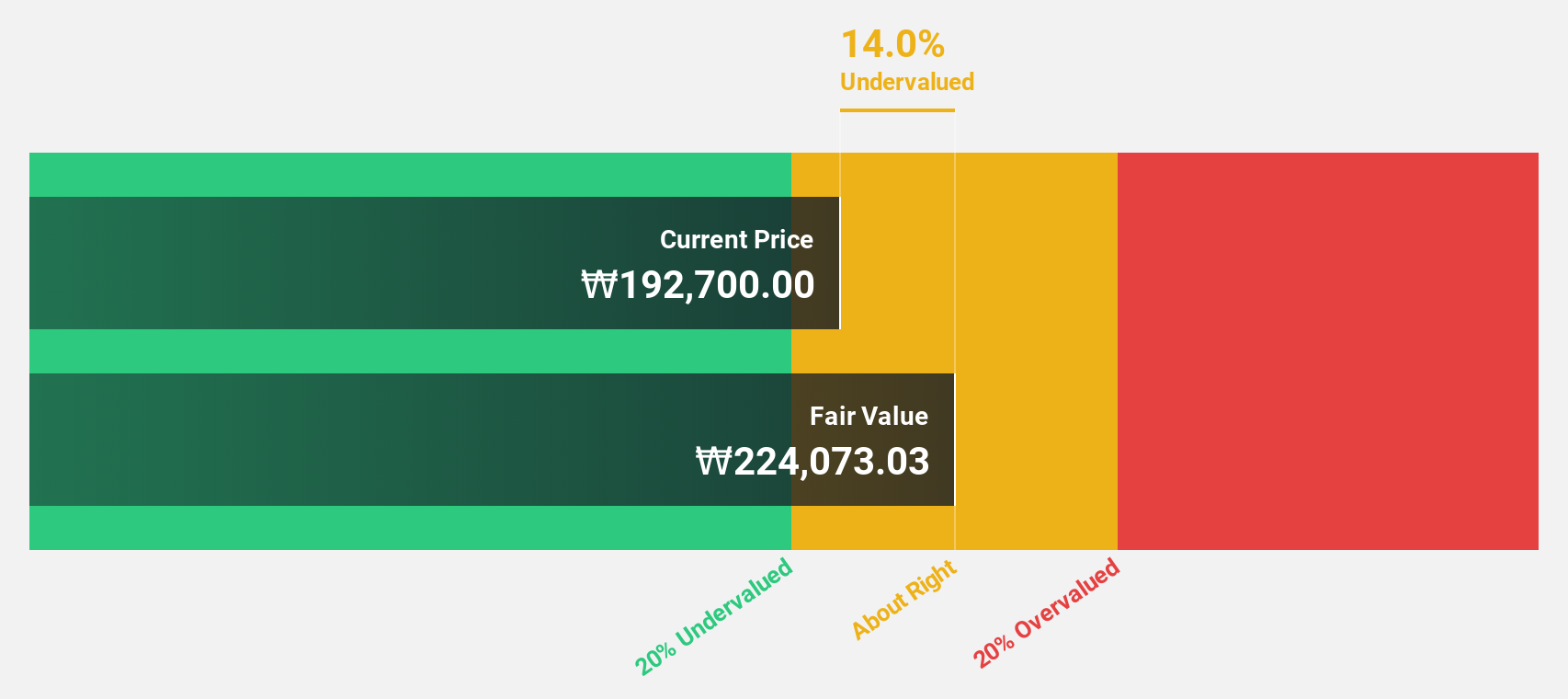

Hd Hyundai MipoLtd (KOSE:A010620)

Overview: Hd Hyundai Mipo Co., Ltd. is a South Korean company that specializes in the manufacturing, repair, and remodeling of ships, with a market cap of ₩9.41 trillion.

Operations: The company's revenue segments include Shipbuilding, which generated ₩5.91 trillion, and Connection Adjustment amounting to -₩989.19 million.

Estimated Discount To Fair Value: 14.1%

Hd Hyundai Mipo Ltd. is trading at a 14.1% discount to its estimated fair value, with earnings projected to grow significantly by 42.6% annually, outpacing the Korean market's growth rate of 27.2%. The company recently became profitable and is involved in a merger with HD Hyundai Heavy Industries, which could impact future cash flows and valuation dynamics. Despite recent volatility in share price, these factors suggest potential undervaluation based on cash flows.

- Insights from our recent growth report point to a promising forecast for Hd Hyundai MipoLtd's business outlook.

- Navigate through the intricacies of Hd Hyundai MipoLtd with our comprehensive financial health report here.

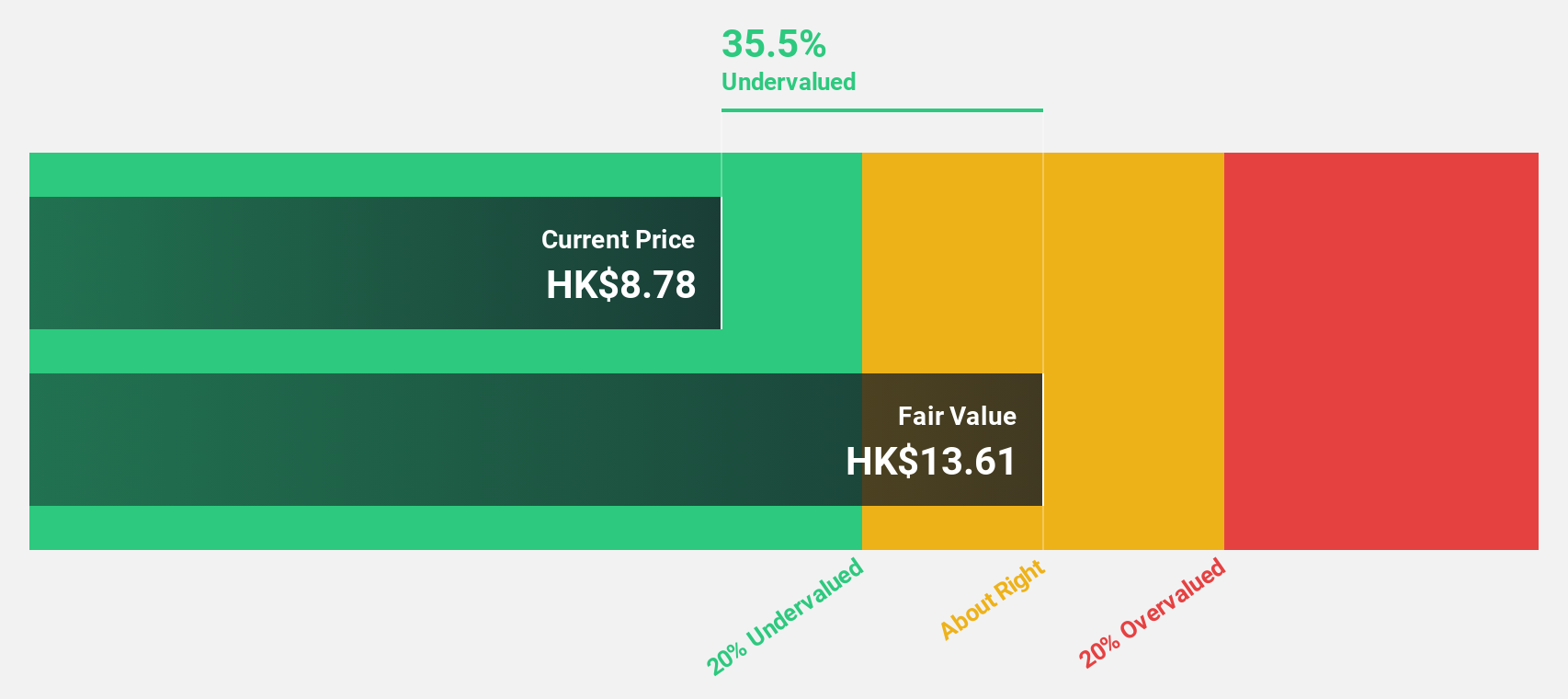

Dongfeng Motor Group (SEHK:489)

Overview: Dongfeng Motor Group Company Limited focuses on the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and auto parts in China with a market cap of HK$78.32 billion.

Operations: The company's revenue segments include Passenger Vehicles at CN¥56.02 billion, Commercial Vehicles at CN¥46.96 billion, and Financing Service at CN¥5.61 billion.

Estimated Discount To Fair Value: 30.4%

Dongfeng Motor Group is trading at HK$9.49, significantly below its estimated fair value of HK$13.63, suggesting it could be undervalued based on cash flows. Despite recent earnings challenges and a volatile share price, the company is expected to achieve profitability within three years with annual profit growth projected above market averages. Recent strategic alliances and increased NEV production indicate potential for future revenue expansion, even as current returns on equity remain low.

- According our earnings growth report, there's an indication that Dongfeng Motor Group might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Dongfeng Motor Group.

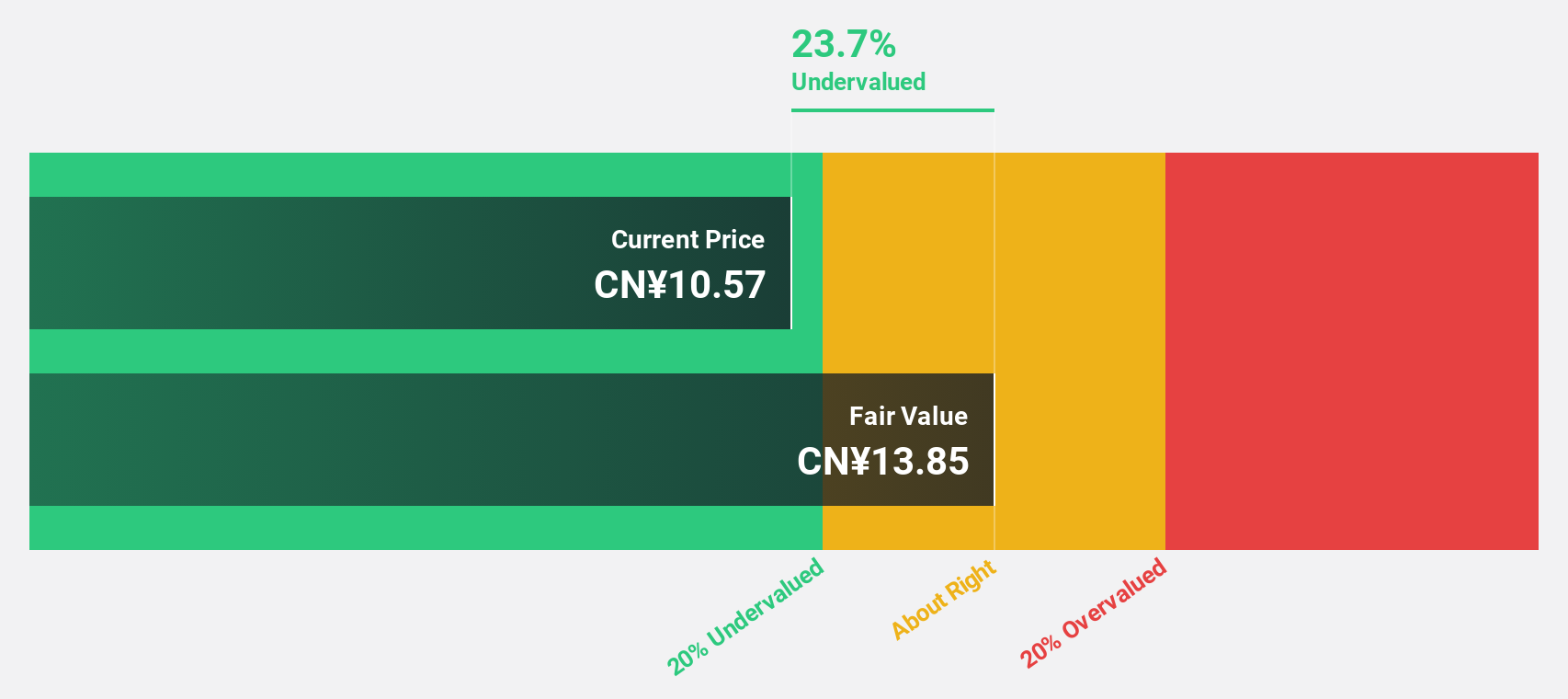

Shenzhen Noposion Crop Science (SZSE:002215)

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, manufacturing, distribution, and technical servicing of pesticides and fertilizers both in China and internationally, with a market cap of CN¥11.55 billion.

Operations: The company generates revenue through its core activities of researching, developing, manufacturing, distributing, and providing technical services for pesticides and fertilizers.

Estimated Discount To Fair Value: 11.1%

Shenzhen Noposion Crop Science is trading at CN¥11.66, slightly below its estimated fair value of CN¥13.11, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow significantly at 31.6% annually, outpacing the market average of 26.3%. Despite high debt levels and a dividend not well covered by free cash flows, recent earnings reports show improved net income and sales growth compared to the previous year.

- In light of our recent growth report, it seems possible that Shenzhen Noposion Crop Science's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Shenzhen Noposion Crop Science stock in this financial health report.

Seize The Opportunity

- Unlock our comprehensive list of 268 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002215

Shenzhen Noposion Crop Science

Researches and develops, manufactures, distributes, and provides technical services for pesticides and fertilizers in China and internationally.

High growth potential with solid track record and pays a dividend.

Market Insights

Community Narratives