Key Takeaways

- Technology-driven efficiency gains and new digital initiatives are expected to lower costs and improve margins.

- Product innovation and market expansion should diversify revenue and drive long-term growth and profitability.

- High exposure to medical cost inflation, agency channels, and product concentration, along with regulatory and market risks, threatens profitability, growth stability, and earnings quality.

Catalysts

About Star Health and Allied Insurance- Provides health insurance products in India.

- Star Health's strong brand recognition and the industry's rising healthcare costs and insurance awareness in India underpin a large, growing addressable market; continued double-digit premium growth and persistency rates above 98% point to sustained revenue expansion ahead.

- Rapid growth in Star's digital distribution channel (73% YoY new business growth, now 20% of total new business) and creation of a digital SBU indicate ongoing technology-driven efficiency gains, which should lower acquisition costs and support future improvements in net margins.

- Ongoing shift to granular, risk-based pricing-including annual repricing and zone-based/discount-oriented models-supports improved underwriting quality and profitability, with potential for declining loss ratios to enhance earnings and net margins over time.

- Strategic product innovation (Super Star, multiyear policies, flexi-network riders) and expansion into new segments and geographies (preferred regions growing 1.5x company average) diversify revenue streams and improve scale, likely boosting both top-line and bottom-line growth.

- Secular gains from India's rising middle class, urbanization, and regulatory initiatives for wider insurance penetration are expected to expand the overall health insurance market, supporting robust premium growth, increased market share, and improved economies of scale for Star Health's revenues and long-term net earnings.

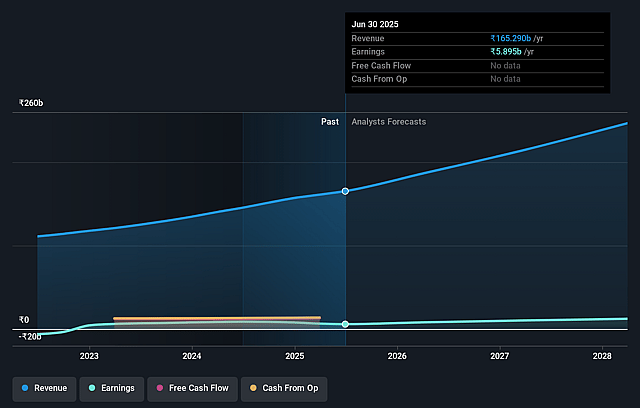

Star Health and Allied Insurance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Star Health and Allied Insurance's revenue will grow by 15.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 5.0% in 3 years time.

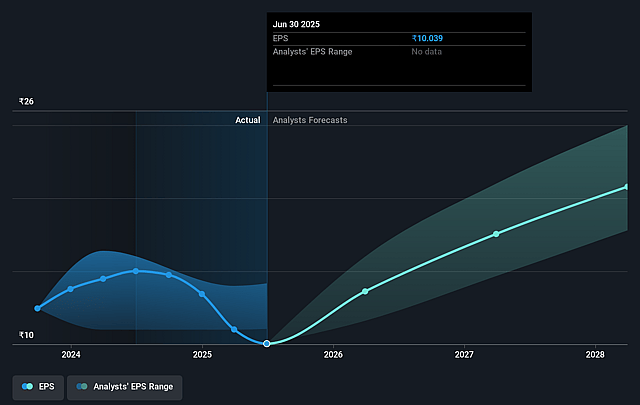

- Analysts expect earnings to reach ₹12.7 billion (and earnings per share of ₹21.44) by about September 2028, up from ₹5.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₹15.0 billion in earnings, and the most bearish expecting ₹10.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.1x on those 2028 earnings, down from 45.1x today. This future PE is lower than the current PE for the IN Insurance industry at 70.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.73%, as per the Simply Wall St company report.

Star Health and Allied Insurance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistently high loss and claim ratios remain a concern, with management acknowledging ongoing industry-wide medical cost inflation and escalating healthcare costs that outpace premium growth, threatening Star Health's underwriting profitability and placing downward pressure on long-term net margins.

- Continued reliance on an agency-driven distribution network (82% of GWP) exposes the company to disruption from digital-first insuretech competitors and direct-to-consumer channels, which could raise customer acquisition costs and erode top-line growth and operating margins if Star Health fails to accelerate digital transformation effectively.

- Product and portfolio concentration risk remains elevated, as approximately 94% of premiums come from the retail health segment and new business growth is concentrated in just a few products (Super Star and Health Assure account for 80% of new business). This lack of diversification increases sensitivity to health inflation, adverse pricing, and regulatory changes, leading to volatile revenue and net earnings.

- The ongoing transition to IFRS accounting and increased mark-to-market gains from a growing allocation to equities (now 17.5% of the portfolio) may result in more volatile reported profits, while returns remain susceptible to investment market downturns-potentially masking weaker core insurance profitability and creating instability in overall earnings.

- Structural industry risks, including the potential for policy interventions such as government expansion of public health schemes or price caps, and increasing regulatory scrutiny with rising compliance and solvency requirements, could suppress private insurance premium growth, increase administrative costs, and limit product innovation, negatively impacting future revenue growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹469.227 for Star Health and Allied Insurance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹530.0, and the most bearish reporting a price target of just ₹415.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹251.7 billion, earnings will come to ₹12.7 billion, and it would be trading on a PE ratio of 31.1x, assuming you use a discount rate of 12.7%.

- Given the current share price of ₹452.05, the analyst price target of ₹469.23 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.