Key Takeaways

- Strategic portfolio reshaping and expansion into emerging markets aim to enhance market presence and increase sales volume.

- Focus on sustainable snacking and operational efficiency expected to attract goodwill and improve net margins, boosting profitability.

- Factors like inflation, geopolitical tensions, and rapid expansion present risks to Mondelez International's profit margins, revenue growth, and operational stability.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Continued investment in brand and capability development is poised to drive multi-year growth in top and bottom lines, enhancing revenue and profitability.

- Strategic portfolio reshaping, including acquisitions (Clif Bar, Ricolino) and divestitures (gum business), is expected to strengthen market presence in key segments and contribute to revenue growth.

- Expansion of distribution channels, especially in emerging markets, aims to significantly increase market penetration and sales volume, impacting revenue positively.

- A focus on operational execution and cost discipline is likely to improve net margins by optimizing expenses and enhancing profitability.

- Increasing investments in sustainable snacking and commitment to sustainability goals may attract consumer and investor goodwill, potentially driving sales and enhancing shareholder value.

Assumptions

How have these above catalysts been quantified?

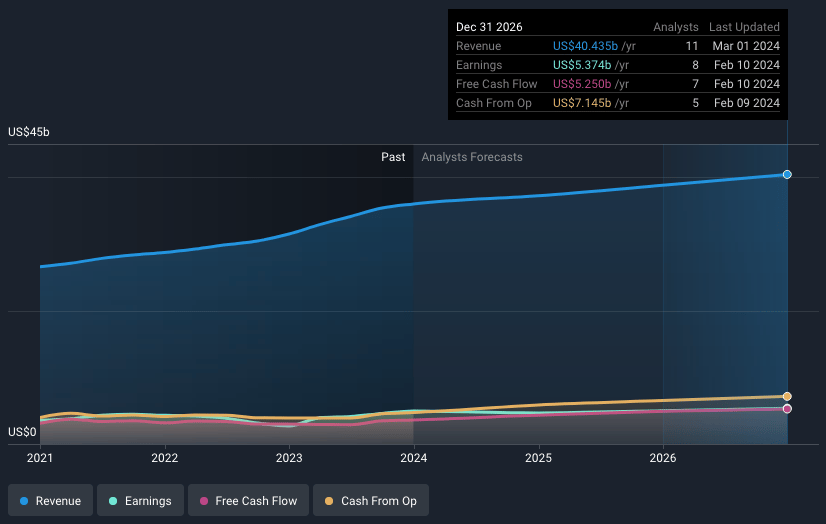

- Analysts are assuming Mondelez International's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.8% today to 13.3% in 3 years time.

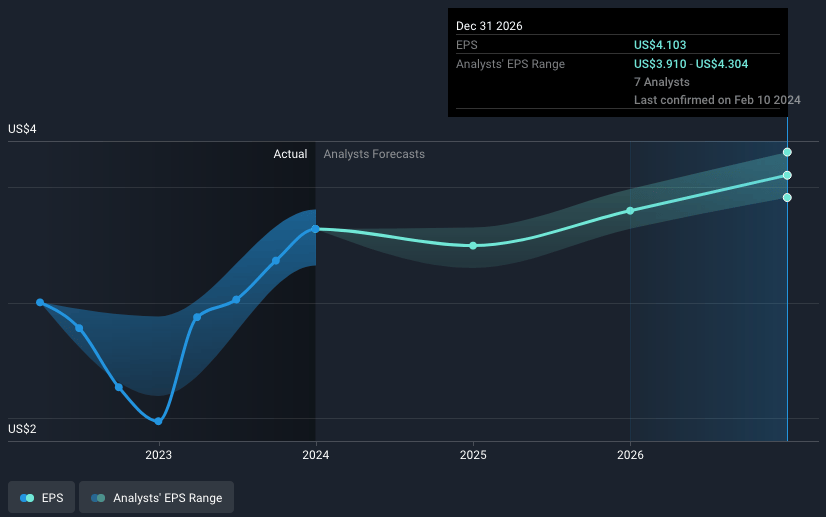

- Analysts expect EPS to reach $4.1 ($5.4 billion in earnings) by about February 2027, up from $3.68 today.

Risks

What could happen that would invalidate this narrative?

- Continued inflation and cost increases, particularly for cocoa and sugar, might strain profit margins if pricing adjustments can't fully offset these costs, impacting net margins.

- The potential for customer disruption, especially in Europe due to annual price negotiations, could temporarily affect revenue growth and earnings until agreements are finalized.

- Geopolitical challenges and regional tensions mentioned could lead to volatility in certain markets (e.g., Middle East), affecting overall revenue stability and growth projections.

- Rapid expansion into new distribution channels and markets introduces execution risks that could impact volume/mix growth and ultimately, revenue projections if not managed effectively.

- The divestiture of the developed market gum business and integration of new acquisitions (e.g., Clif Bar, Ricolino) present operational and financial challenges that could affect short-term earnings as the company works to offset these impacts and achieve synergies.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.