Key Takeaways

- The myPlan subscription service's success and strategic focus on operational excellence and debt reduction are poised to enhance Verizon's financial health and shareholder value.

- Expansion into new markets with innovative technology and strategic partnerships aimed at enterprise solutions are key drivers for Verizon's future growth and customer base expansion.

- Industry saturation and competition, regulatory changes, substantial capital investment needs, cybersecurity risks, and reliance on third-party partnerships could impact Verizon's financial health.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The launch and success of the myPlan subscription service, which garnered 13.1 million subscribers by offering flexible plans tailored to U.S. consumer needs, can likely increase average revenue per account (ARPA) due to customers choosing premium packages and unique perks.

- Verizon's focus on operational excellence and significant reductions in leverage, combined with disciplined capital allocation towards strategic and profitable growth, are poised to improve net margins and strengthen the company's financial position.

- The substantial free cash flow generation of $18.7 billion, attributed to disciplined operations and strategic growth initiatives, positions Verizon to further reduce debt and potentially increase dividends, enhancing shareholder value.

- Expansion into suburban and rural markets with fixed wireless access and C-Band spectrum deployment is expected to significantly grow the customer base and wireless service revenue, given the already noted higher gross adds and lower churn in C-Band markets.

- Strategic partnerships and the development of private networks for enterprises, along with leveraging Verizon Business to efficiently deliver post-sale customer support, opens new revenue streams and can potentially boost Verizon's business customer segment performance, affecting overall revenue growth.

Assumptions

How have these above catalysts been quantified?

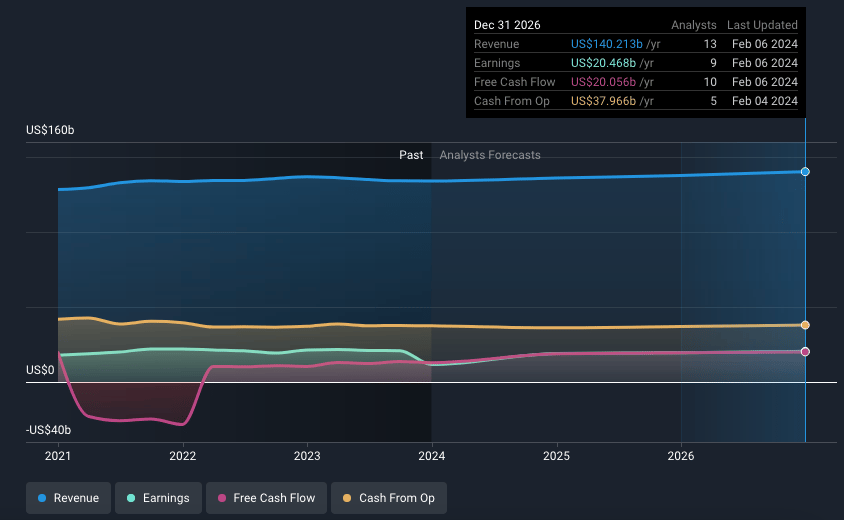

- Analysts are assuming Verizon Communications's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 14.6% in 3 years time.

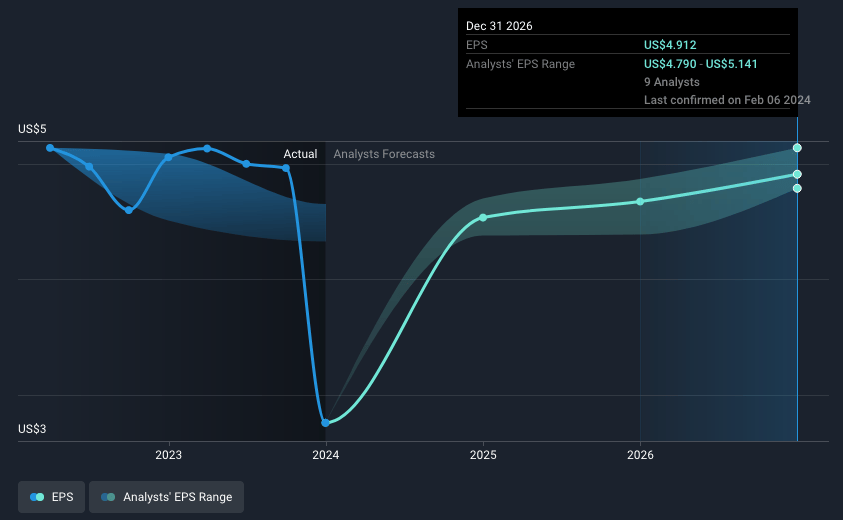

- Analysts expect EPS to reach $4.91 ($20.5 billion in earnings) by about February 2027, up from $2.76 today.

Risks

What could happen that would invalidate this narrative?

- The industry's competition and the saturation of the wireless market might put pressure on Verizon's ability to acquire new customers and retain its market share, affecting revenue growth.

- Potential regulatory changes or intervention could impact operational flexibility, increasing operational costs or limiting revenue opportunities.

- The continuous need for substantial capital investment in network infrastructure, including the expansion and upgrading for 5G, might strain cash flow and affect net margins.

- Any significant cybersecurity incidents or data breaches could lead to substantial financial liabilities and damage the brand, impacting earnings.

- The reliance on third-party partnerships for the distribution and technological advancements could risk operational delays or increased costs, affecting net margins and earnings.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.