Key Takeaways

- Strategic investments in COVID testing and focused R&D have positioned Abbott for sustainable growth through diversified products and operational efficiency.

- Launching new products, including in the Nutrition and Established Pharmaceuticals divisions, along with key diagnostics technologies, are driving significant revenue growth and market leadership.

- Reliance on declining COVID-19 testing sales, competition in medical devices, exchange rate impacts, and uncertain growth from new ventures pose significant risks.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Strategic investments during peak COVID testing have strengthened Abbott Laboratories across all business segments, positioning the company for top-tier sustainable growth due to enhanced product portfolios and operational efficiency. This diversification and strengthening are expected to contribute significantly to revenue and net margins.

- Focused R&D investments have culminated in announcing over 25 new growth opportunities, including new products, indications, and geographical expansions, which are expected to drive significant revenue growth and improve the company's earnings profile.

- The Nutrition and Established Pharmaceuticals (EPD) divisions are achieving double-digit growth, with the Adult Nutrition segment and the commercialization of several biosimilars in emerging markets poised to significantly boost revenue.

- In the Medical Devices and Diagnostics segments, the introduction of new products and the expansion of existing portfolios, such as the Alinity systems and the FreeStyle Libre, Abbott's market-leading continuous glucose monitoring system, are expected to not only drive revenue growth but also enhance market leadership and penetration in high-growth areas.

- Abbott's outlook for 2024, forecasting organic sales growth of more than $3 billion and adjusted earnings per share indicating double-digit earnings growth on the base business, highlights the company's confidence in sustained operational efficiency and profitability improvement, signaling potential undervaluation of the stock.

Assumptions

How have these above catalysts been quantified?

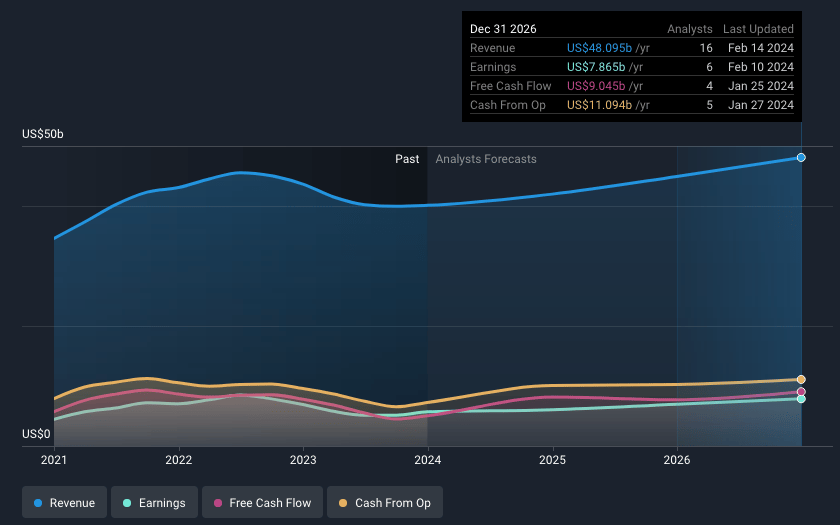

- Analysts are assuming Abbott Laboratories's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.3% today to 16.4% in 3 years time.

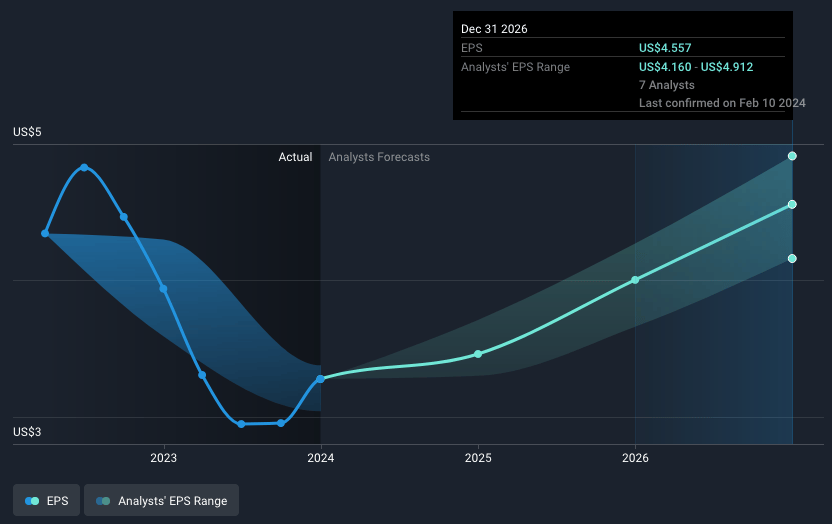

- Analysts expect EPS to reach $4.56 ($7.9 billion in earnings) by about February 2027, up from $3.3 today.

Risks

What could happen that would invalidate this narrative?

- The reliance on COVID-19 testing sales, which experienced a significant decline, represents a risk to future earnings stability as the pandemic wanes and demand for COVID testing decreases.

- Market saturation and increasing competition in the medical devices segment, especially in areas like continuous glucose monitoring (CGM) systems, could pressure revenue growth and profit margins in a key area of the business.

- Exchange rate fluctuations were mentioned as having an unfavorable impact on reported sales, posing a risk to revenue growth especially as a significant portion of their business is international.

- The transition from pandemic-driven sales to a focus on core business areas might not yield expected growth rates if new product launches and pipeline opportunities do not materialize as projected or face regulatory and market acceptance challenges.

- The company's strategic focus on investing in high-growth areas such as Adult Nutrition and biosimilars in emerging markets requires significant upfront costs and faces execution risk, which could impact net margins and earnings if these investments do not meet performance expectations.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.