Key Takeaways

- Focus on value-added services and new payment technologies suggests Mastercard's potential for higher transaction volumes and improved customer retention.

- Strategic ventures, especially in China and real-time payments, position Mastercard for significant market share growth and revenue increase.

- Mastercard's revenue growth is at risk from macroeconomic shifts, credit market changes, inflation, geopolitical uncertainties, and competitive and regulatory challenges in new markets.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Mastercard's continued growth in value-added services and solutions, such as Cyber & Intelligence and consulting, indicates an ability to leverage its extensive data and insights to drive further revenue growth and improve operating margins.

- Expansion into new payment flows and a focus on accelerating the secular shift to electronic payments, as demonstrated by their efforts in open banking and Pay-by-Bank initiatives, suggest potential for increased transaction volumes and revenue.

- Strategic focus on enhancing digital transaction experiences through technologies like tap to pay, Click to Pay, and biometric payment capabilities could lead to higher adoption rates, potentially increasing transaction volumes and improving customer retention.

- The joint venture in China receiving formal approval to commence domestic bank card clearing positions Mastercard to tap into the vast Chinese market, potentially boosting cross-border spend and increasing market share in a significant emerging market, positively impacting revenue and earnings.

- Investments in real-time payments and strategic partnerships, such as the one with The Clearing House, are likely to strengthen Mastercard's position in this growing segment, enabling the company to capitalize on the shift towards faster payment solutions and thereby driving transaction growth and revenue.

Assumptions

How have these above catalysts been quantified?

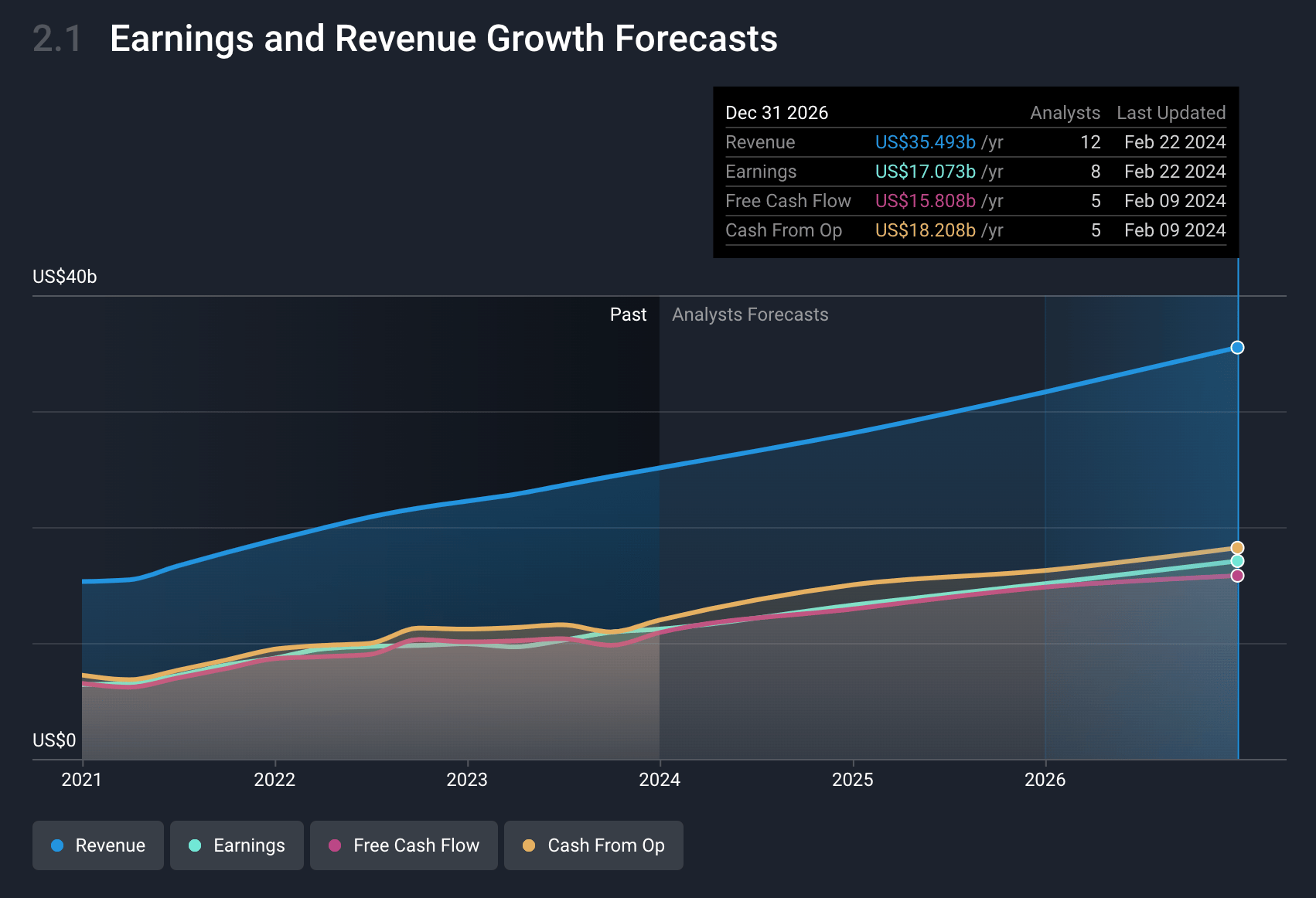

- Analysts are assuming Mastercard's revenue will grow by 12.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 44.6% today to 48.6% in 3 years time.

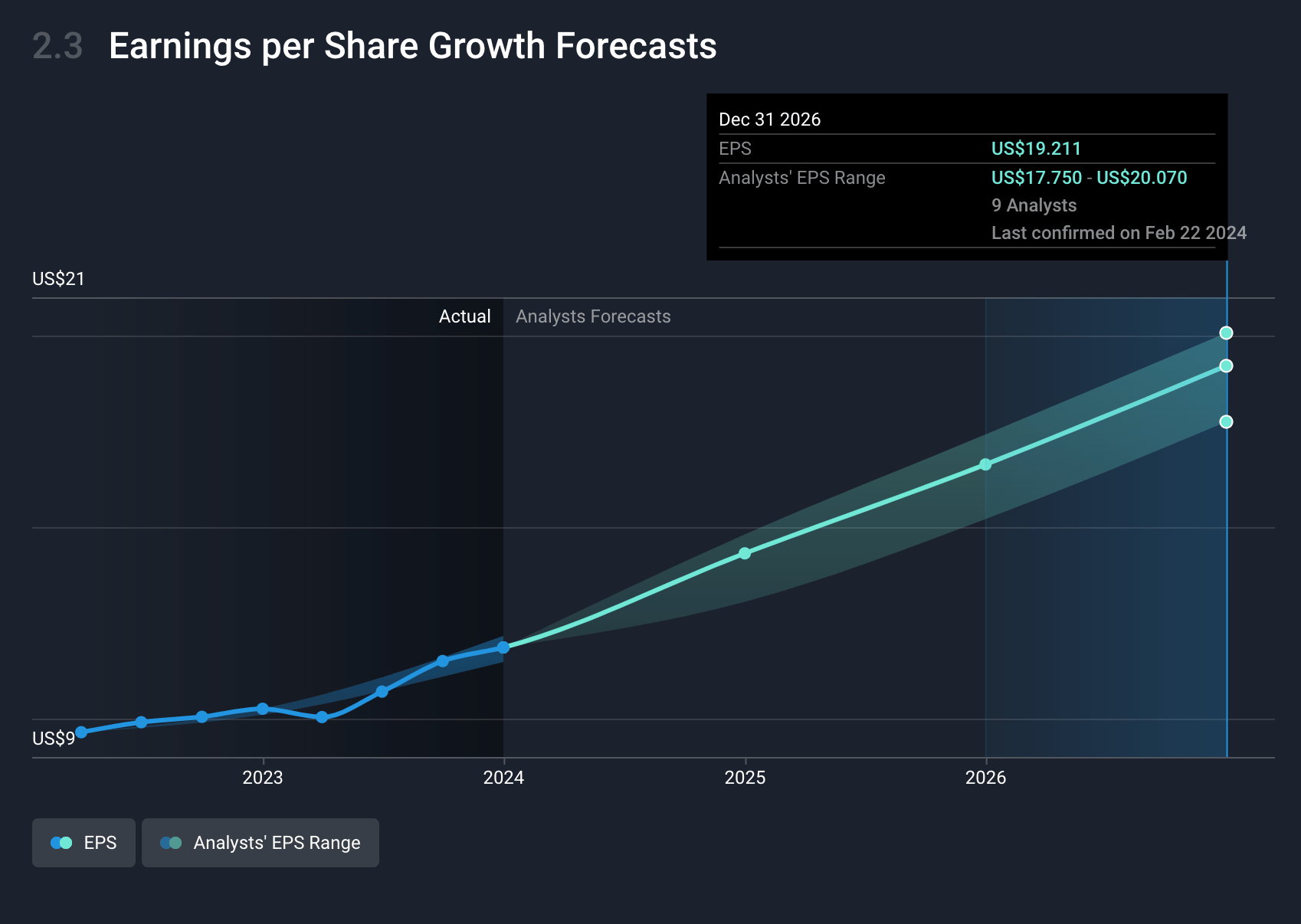

- Analysts expect EPS to reach $19.38 ($17.2 billion in earnings) by about February 2027, up from $12.0 today.

Risks

What could happen that would invalidate this narrative?

- Geopolitical uncertainty in several markets could lead to decreased consumer spending or hinder Mastercard's ability to operate effectively in affected regions, impacting revenue growth. - Credit availability and delinquency rates are being closely monitored, indicating potential risks in consumer credit health that could affect transaction volumes and, consequently, revenues.

- Intense competition in payment solutions and new technologies (e.g., real-time payments, open banking) might challenge Mastercard's market share, potentially impacting revenue growth from payment processing fees.

- Regulatory changes and increased scrutiny in various jurisdictions could result in higher compliance costs or operational limitations, affecting net margins and earnings.

- Macro-economic factors such as inflation and interest rates managed by central banks may influence consumer spending habits, potentially leading to reduced transaction volumes and impacting revenue growth.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.