Key Takeaways

- Investment in supply chain and new technologies like Quantum Computing and sustainable aviation fuels aimed at boosting revenue and margin growth.

- Acquisition of Carrier's Global Access Solutions and focus on aftermarket services set to lead in security solutions and enhance profitability.

- Supply chain issues, market recovery uncertainties, distributor destocking, investment hesitancies, and constrained pricing strategies could impede revenue growth and margin expansion.

Catalysts

What are the underlying business or industry changes driving this perspective?

- Honeywell's continued investment in supply chain improvements and supplier recovery is expected to enhance Aerospace segment production, driving revenue growth and maintaining margin levels, impacting both top and bottom line.

- Acceleration in software offerings and sustainable technology solutions, notably in Quantum Computing through Quantinuum and sustainable aviation fuels, is projected to open up new revenue streams and enhance margins through high-growth, high-margin businesses.

- The strategic acquisition of Carrier's Global Access Solutions business for nearly $5 billion positions Honeywell as a leader in security solutions for the digital age, contributing to revenue growth and margin expansion in the Building Technologies segment.

- Honeywell's focus on growing its aftermarket services, particularly within the Aerospace and Warehouse Automation segments, leverages its large installed base for recurring revenue, positively impacting margins and overall profitability.

- Organizational efficiency improvements and productivity gains from the deployment of Honeywell Accelerator version 3.0 are expected to drive margin expansion across all segments by standardizing operations and leveraging digital capabilities.

Assumptions

How have these above catalysts been quantified?

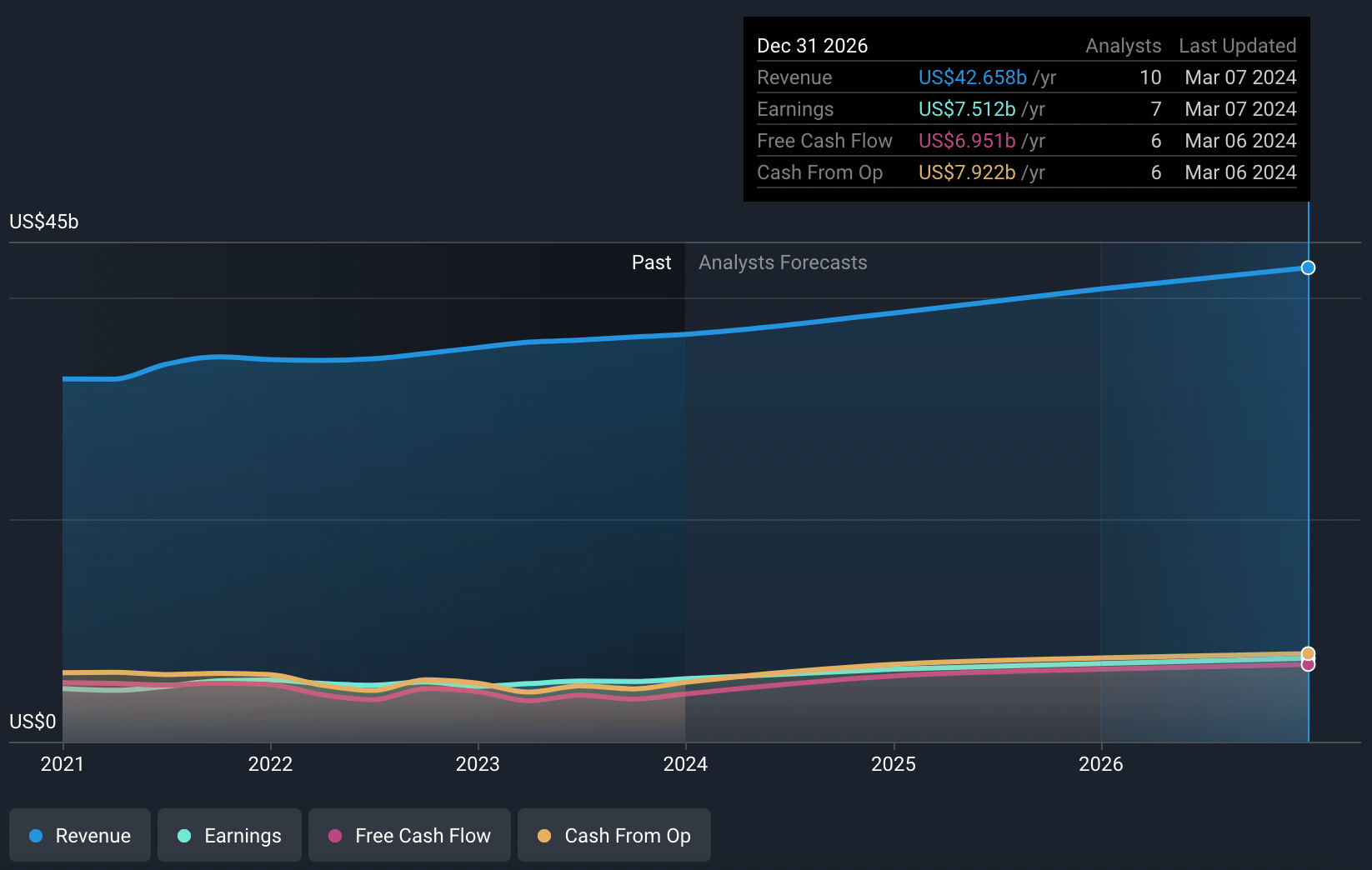

- Analysts are assuming Honeywell International's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.4% today to 17.6% in 3 years time.

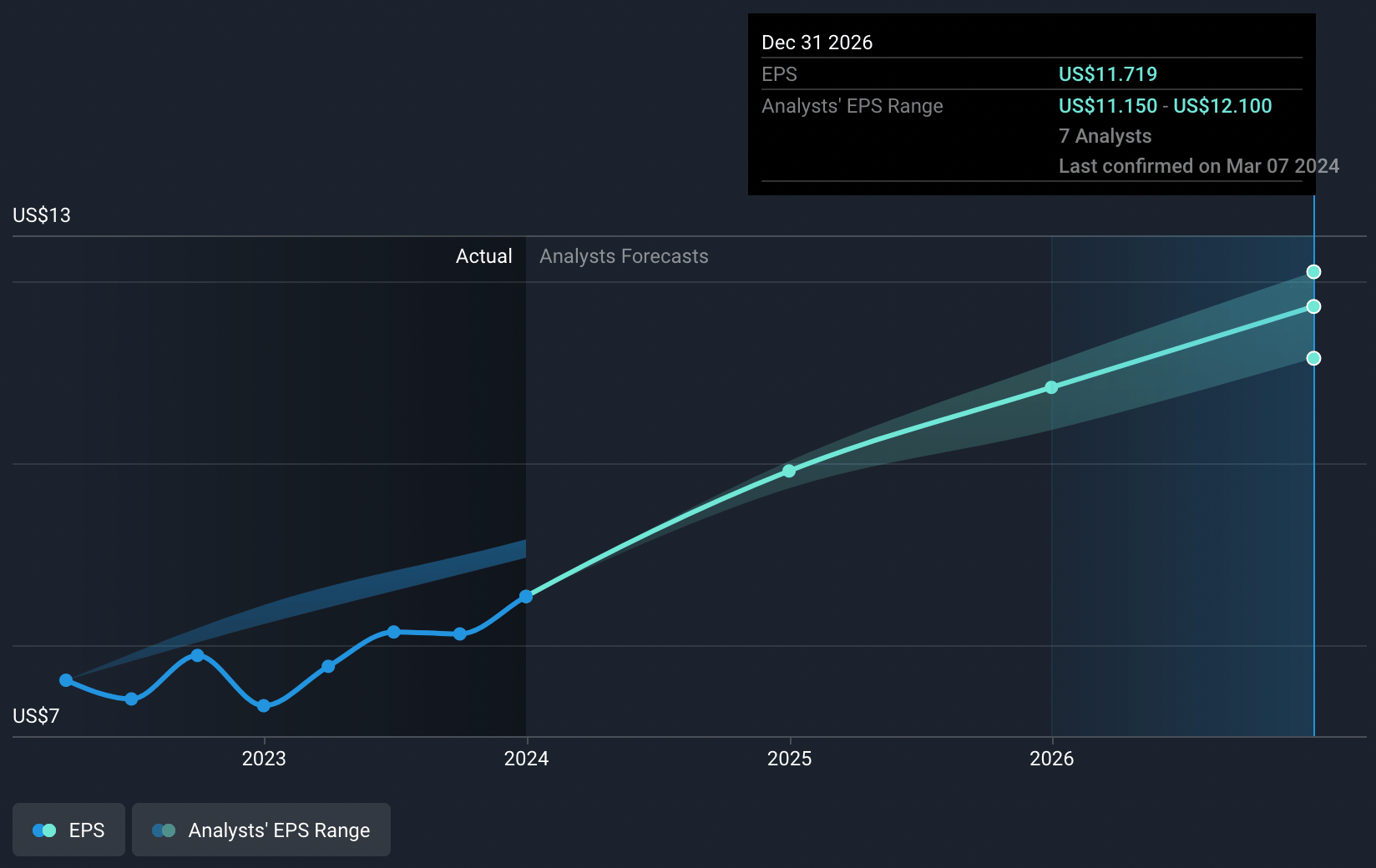

- Analysts expect earnings to reach $7.5 billion (and earnings per share of $11.72) by about March 2027, up from $5.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.7x on those 2027 earnings, down from 22.6x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.21%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Supply chain constraints, particularly in the Defense & Space segment, could limit volume growth, restricting revenue increases.

- The short-cycle market recovery timing and pace are uncertain, which could impact revenues across various segments like Industrial Automation and Energy and Sustainability Solutions.

- Ongoing distributor destocking in the Building Technologies segment suggests potential volatility in short-cycle revenues, impacting overall segment growth.

- Despite a solid pipeline for Warehouse Automation projects, customer hesitancy to invest amid market uncertainties could delay expected recoveries, impacting revenues in the Safety and Productivity Solutions segment.

- The pricing strategy, aiming for a 3% increase, primarily leans on sectors outside Aerospace, where contracts might constrain pricing power, potentially affecting net margins if input costs rise unexpectedly.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $221.25 for Honeywell International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $42.7 billion, earnings will come to $7.5 billion, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of $196.35, the analyst's price target of $221.25 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.