Last Update 06 Sep 25

With both the discount rate and future P/E ratio showing only marginal movements, there has been no meaningful change in analysts' fair value estimate for Keikyu, with the consensus price target remaining steady at ¥1565.

What's in the News

- Completed repurchase of 4,067,744 shares (1.48%) for ¥6,200 million under announced buyback.

- Board meeting held to consider acquisition of treasury shares.

- Board meeting held to consider nominations of Executive Officers and General Managers, and partial changes to operational organization.

Valuation Changes

Summary of Valuation Changes for Keikyu

- The Consensus Analyst Price Target remained effectively unchanged, at ¥1565.

- The Discount Rate for Keikyu remained effectively unchanged, moving only marginally from 6.82% to 6.69%.

- The Future P/E for Keikyu remained effectively unchanged, moving only marginally from 17.76x to 17.83x.

Key Takeaways

- Strong rail ridership, inbound tourism, and real estate development drive revenue growth, margin expansion, and earnings stability.

- Digitalization, operational efficiencies, and real estate diversification enhance margins, recurring income, and long-term resilience.

- Declining property sales, higher debt and operating costs, shrinking cash reserves, and non-recurring profits threaten earnings stability, margin strength, and financial flexibility.

Catalysts

About Keikyu- Engages in the railway transportation business in Japan.

- The ongoing urbanization and high population density in Greater Tokyo is fueling sustained increases in rail ridership, as evidenced by year-on-year passenger growth (+2.3%) and especially robust expansion in airport station traffic (+8.1%), supporting stable or growing fare revenue for Keikyu and directly boosting top-line revenue and long-term earnings power.

- Rising demand from inbound tourism and international travel, paired with strategic real estate development around transit hubs (e.g., Shinagawa Station/Takanawa 3-Chome project, hotel renovations), is expected to drive higher unit prices, occupancy rates, and premium fare segments, supporting both revenue growth and margin expansion.

- Adoption of improved digitalization and operational efficiencies, seen in cost containment and deferral of some repair expenses, points to a trajectory of enhanced margin performance and earnings growth as automation and smart infrastructure continue to be integrated across rail and non-rail businesses.

- Formation of a private REIT business and accelerated real estate turnover strategy, including partnerships with major financial institutions and expansion of rental/leasing projects, is set to diversify and stabilize recurring income streams, supporting both top-line growth and improved return on capital.

- Increased capital investment in strategic development projects and asset upgrades positions Keikyu to benefit from both environmental preferences for sustainable transport and the modal shift away from private vehicles, potentially capturing greater market share and supporting long-term revenue and resilience in net earnings.

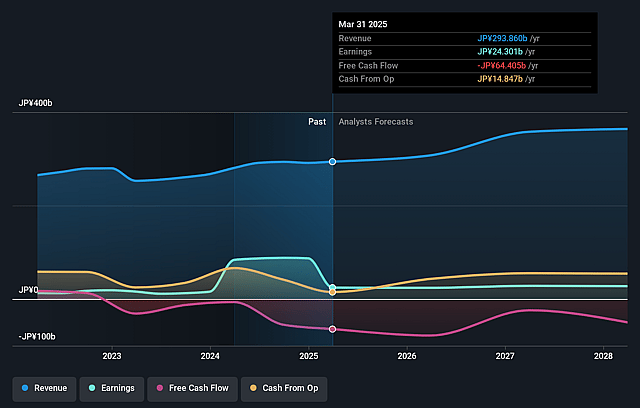

Keikyu Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Keikyu's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 7.9% in 3 years time.

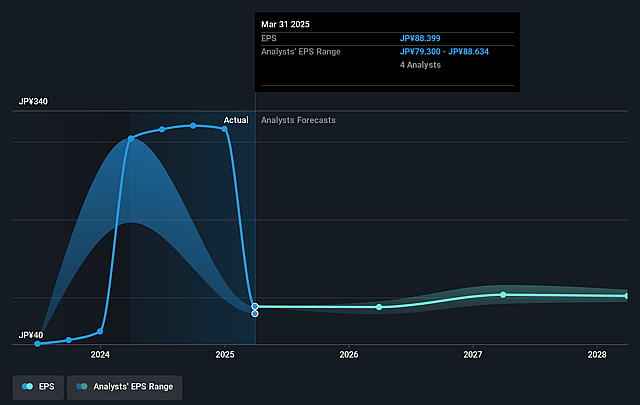

- Analysts expect earnings to reach ¥28.2 billion (and earnings per share of ¥105.79) by about September 2028, up from ¥22.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 18.6x today. This future PE is greater than the current PE for the JP Transportation industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Keikyu Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Real Estate segment experienced a significant decline in both revenue and profit year-on-year due to the absence of large site sales and underwhelming condominium sales, which may indicate longer-term challenges with property demand and the ability to sustain high-margin non-rail income streams, directly impacting earnings stability and net margins.

- Non-operating expenses rose by ¥0.5 billion, mainly due to increased interest expenses and the issuance of corporate bonds, pointing to rising financing costs and a heavier debt burden that may pressure net profit and reduce financial flexibility for future investments.

- Share buybacks and substantial capital investment (along with declining cash and increased debt) have reduced the company's cash reserves, potentially curtailing future strategic flexibility and increasing the risk of liquidity constraints, which could limit growth initiatives and squeeze net margins.

- Personnel expenses in railway operations increased due to rising salaries, and repair expenses have been deferred to later quarters instead of being permanently reduced, heightening the likelihood of ballooning operating costs in the near future and exerting downward pressure on margins and operating profit.

- Continued profit declines attributable to factors such as the absence of tax effects and one-off asset disposals suggest that recurring, sustainable profits may be less robust than headline revenue growth indicates, which increases uncertainty over core earnings quality and risks volatility in reported net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1565.0 for Keikyu based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥355.4 billion, earnings will come to ¥28.2 billion, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 6.8%.

- Given the current share price of ¥1569.5, the analyst price target of ¥1565.0 is 0.3% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.