Last Update 08 Dec 25

Fair value Increased 0.83%A012450: Higher Future P E Should Support Stronger Share Price Upside

Analysts have nudged their fair value estimate for Hanwha Aerospace slightly higher, from approximately 1,315,870 to 1,326,739, citing modestly stronger long term revenue growth expectations. These expectations more than offset a marginally higher discount rate and slightly softer projected profit margins.

Valuation Changes

- Fair Value Estimate has risen slightly from approximately ₩1,315,870 to about ₩1,326,740, reflecting modestly stronger long term assumptions.

- Discount Rate has increased marginally from about 8.03 percent to roughly 8.07 percent, implying a slightly higher required return.

- Revenue Growth has inched up from around 10.64 percent to approximately 10.66 percent, indicating a small upgrade to long term growth expectations.

- Net Profit Margin has edged down slightly from about 8.26 percent to roughly 8.25 percent, suggesting a modestly more conservative margin outlook.

- Future P/E has risen slightly from about 40.4x to roughly 40.8x, consistent with the higher fair value under updated assumptions.

Key Takeaways

- Expanded export volumes and new contracts in the Land Systems division drive strong anticipated revenue growth and bolster overall company performance.

- Strategic consolidation in defense and naval shipbuilding and localization strategies enhance synergies and profit margins, despite potential short-term revenue impact.

- Increased net debt and potential geopolitical shifts may strain financial stability and defense revenue, while one-time accounting changes mask sustainable earnings.

Catalysts

About Hanwha Aerospace- Engages in the development, production, and maintenance of aircraft engines worldwide.

- The Land Systems division is expected to drive approximately 20% revenue growth in 2025, fueled by continued strong domestic mass production and increased export volumes, particularly with expanded deliveries to Poland and new contracts for Australia and Egypt, which will positively impact overall revenue.

- The acquisition and consolidation of Hanwha Ocean as a subsidiary are set to enhance synergies in defense and naval shipbuilding, leading to increased strategic control and potentially translating expected enterprise value growth into increased corporate value for Hanwha Aerospace, thereby boosting earnings.

- Continuous growth in the order backlog, which stood at ₩32,400 trillion by the end of 2024, backed by new contracts and persistent geopolitical tensions driving global defense market expansion, is expected to sustain revenue growth and maintain strong net margins.

- The Aerospace division anticipates revenue growth in 2025 due to increased military and long-term agreement (LTA) volumes, despite some anticipated RSP-related operating losses, indicating potential for improved profit margins over time.

- The localization strategy for manufacturing products and parts in customer countries could lead to a slight decline in total revenue size but an increase in profit margins, focusing on exporting key profitable components, which should enhance net margins.

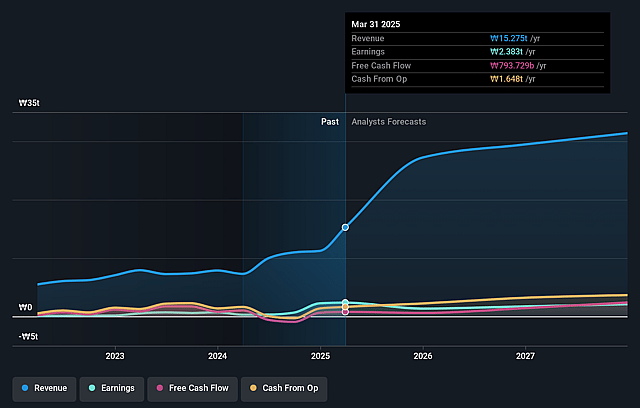

Hanwha Aerospace Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Hanwha Aerospace's revenue will grow by 17.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.7% today to 8.4% in 3 years time.

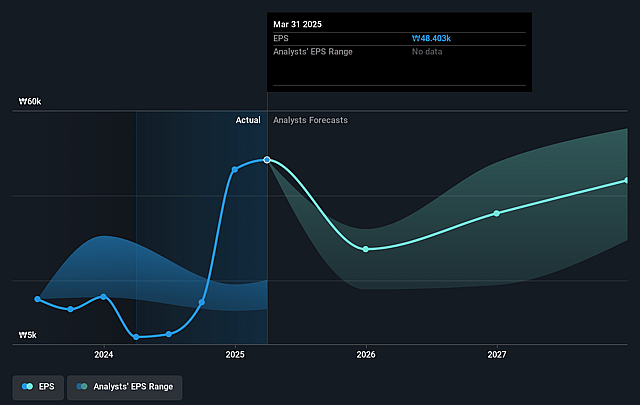

- Analysts expect earnings to reach ₩2623.8 billion (and earnings per share of ₩51311.11) by about September 2028, up from ₩2441.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ₩3675.0 billion in earnings, and the most bearish expecting ₩1522.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, up from 19.8x today. This future PE is greater than the current PE for the KR Aerospace & Defense industry at 26.7x.

- Analysts expect the number of shares outstanding to grow by 3.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.18%, as per the Simply Wall St company report.

Hanwha Aerospace Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The significant increase in net debt ratio to 64%, following the consolidation of Hanwha Ocean, may strain financial stability, potentially impacting net margins due to higher interest obligations.

- The Aerospace segment reported operating losses associated with the GTF RSP, with projections that increased engine deliveries will escalate RSP-related losses, threatening future earnings.

- The localization of manufacturing in foreign countries could reduce total revenue, even if profitability per unit improves, potentially affecting overall revenue growth forecasts.

- Potential geopolitical shifts or an abrupt end to conflicts in key markets like Poland could alter defense spending patterns, which could affect revenue from defense contracts.

- The significant non-operating profit increase is largely due to accounting changes related to Hanwha Ocean. Such one-time accounting adjustments do not reflect sustainable earnings improvements.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₩1264250.0 for Hanwha Aerospace based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₩1450000.0, and the most bearish reporting a price target of just ₩1000000.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₩31216.2 billion, earnings will come to ₩2623.8 billion, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of ₩941000.0, the analyst price target of ₩1264250.0 is 25.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Hanwha Aerospace?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.