Last Update 05 Sep 25

With both the discount rate and future P/E ratio remaining essentially flat, the consensus analyst price target for Gulf Oil Lubricants India is unchanged at ₹1655.

What's in the News

- Board meeting scheduled to consider and approve unaudited standalone and consolidated financial results for the first quarter ended June 30, 2025, subject to a limited review by statutory auditors.

Valuation Changes

Summary of Valuation Changes for Gulf Oil Lubricants India

- The Consensus Analyst Price Target remained effectively unchanged, at ₹1655.

- The Discount Rate for Gulf Oil Lubricants India remained effectively unchanged, moving only marginally from 13.66% to 13.67%.

- The Future P/E for Gulf Oil Lubricants India remained effectively unchanged, moving only marginally from 21.58x to 21.59x.

Key Takeaways

- Capacity expansion, premium product launches, and new OEM partnerships are set to drive sustained double-digit growth and margin improvement across core lubricant markets.

- Diversification into EV charging and deeper rural penetration enhance long-term revenue opportunities and position the company for robust, above-industry volume growth.

- Accelerated shift to electric vehicles, rising costs, regulatory changes, and intensifying competition threaten core lubricant revenues and margins, challenging Gulf Oil Lubricants India's long-term earnings stability.

Catalysts

About Gulf Oil Lubricants India- Manufactures, markets, and trades lubricating oils, greases, and other derivatives for use in the automobile and industrial sectors in India.

- Capacity expansion from 140 million to 240 million units by March 2027 positions the company to capture increased lubricant demand driven by ongoing growth in vehicle penetration and rising disposable incomes in India, supporting sustained double-digit volume and revenue growth from FY28 onwards.

- Upgrades and launches of premium, higher-specification products (e.g., Gulf Pride motorcycle oil with API SP grade) alongside brand-led activations are accelerating the company's shift toward higher-margin, value-added products, which is likely to drive further gross margin expansion and long-term earnings growth.

- Strategic partnerships with OEMs (including new tie-ups with Nayara and strong presence at franchisee workshops) and deeper rural distribution are expanding market access and share, resulting in improved revenue visibility and potential for above-industry volume growth in underpenetrated segments.

- Significant growth in the EV charger (Tirex) subsidiary-targeting 2x annual revenue increase and aiming for ₹400–500 crore topline in 4–5 years-provides a diversification catalyst that leverages the ongoing acceleration in India's EV adoption, supporting consolidated revenue growth and future EBITDA expansion.

- Accelerating industrial and infrastructure volume growth (with low current market share of <5%) positions Gulf Oil Lubricants India to capitalize on India's long-term manufacturing and infrastructure buildout, expanding its addressable market and supporting multi-year expansion in consolidated revenues and profitability.

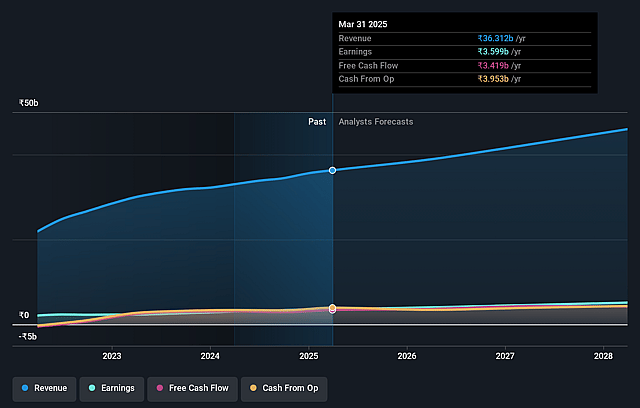

Gulf Oil Lubricants India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gulf Oil Lubricants India's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.8% today to 11.8% in 3 years time.

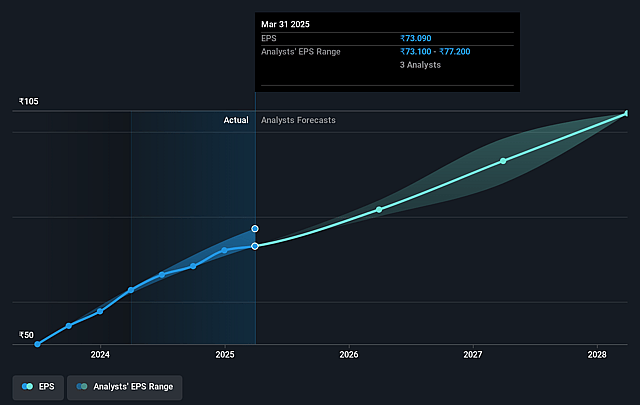

- Analysts expect earnings to reach ₹5.5 billion (and earnings per share of ₹105.3) by about September 2028, up from ₹3.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from 16.9x today. This future PE is lower than the current PE for the IN Chemicals industry at 26.8x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.66%, as per the Simply Wall St company report.

Gulf Oil Lubricants India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated adoption of Electric Vehicles (EVs) in India poses a long-term threat to traditional lubricant demand, particularly in the automotive segment, which remains Gulf Oil Lubricants India's core revenue driver-potentially resulting in structural revenue decline as ICE vehicle penetration decreases.

- Rising input costs and volatility in base oil and additives prices, compounded by persistent currency fluctuations and the company's inability to fully pass on increases due to competitive pricing pressures, could lead to sustained margin compression and negatively impact net profits.

- Increasing regulatory focus on environmental standards and sustainability (e.g., Bharat VII norms, decarbonization policies) may require significant R&D and compliance investments, driving up costs and potentially forcing the phase-out or reformulation of existing product lines, which could erode long-term earnings and operating margins.

- Intensifying competition from both established lubricant brands and private-label/unorganized sector players in rural and price-sensitive urban markets can trigger price wars, reduce the effectiveness of brand premium, pressure volumes, and ultimately undermine Gulf Oil Lubricants India's gross margins and market share.

- The currently small EV charger (Tirex) and battery businesses, while showing high growth rates, remain negligible contributors to top-line and profitability; failure to rapidly scale or achieve margin parity with the core lubricant business may limit Gulf's ability to offset long-term declines in traditional revenues, risking future overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1655.4 for Gulf Oil Lubricants India based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹46.6 billion, earnings will come to ₹5.5 billion, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 13.7%.

- Given the current share price of ₹1264.5, the analyst price target of ₹1655.4 is 23.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.