Key Takeaways

- Increased demand for renewables, due to more favorable conditions and clearer import guidelines, expected to drive revenue growth.

- Strategic diversification and strengthening of the supply chain, including procuring essential components, expected to ensure uninterrupted project timelines and positively impact revenue and net margins.

- Inflation and higher interest rates, supply chain challenges in solar, rising competition, regulatory risks, and dependency on project financing could impact profitability and growth.

Catalysts

What are the underlying business or industry changes driving this perspective?

- The expectation of increased demand for renewables in 2024 and beyond due to more favorable conditions such as decreased inflation and interest rates, and clearer guidelines around solar equipment importation, expected to drive revenue growth.

- Execution of a strategy to diversify and strengthen the supply chain, particularly with procuring enough transformers and breakers for projects through 2027, is likely to ensure uninterrupted project timelines and positive impact on revenue and net margins.

- The plan to repower approximately 985 megawatts of wind through 2026, leveraging existing infrastructure for enhanced returns, is expected to contribute substantially to earnings growth.

- An aggressive capital plan ($32 billion to $34 billion) aligned with strategic investments in renewables, specifically solar, and transmission projects supporting the company’s growth through at least 2025 and positively impacting net margins and earnings.

- The strategic position of Energy Resources and FPL, focusing on capital deployment in renewables and transmission, presents substantial growth opportunities bolstered by an increasing push towards electrification and a robust development pipeline, expected to significantly influence revenue, net margins, and earnings.

Assumptions

How have these above catalysts been quantified?

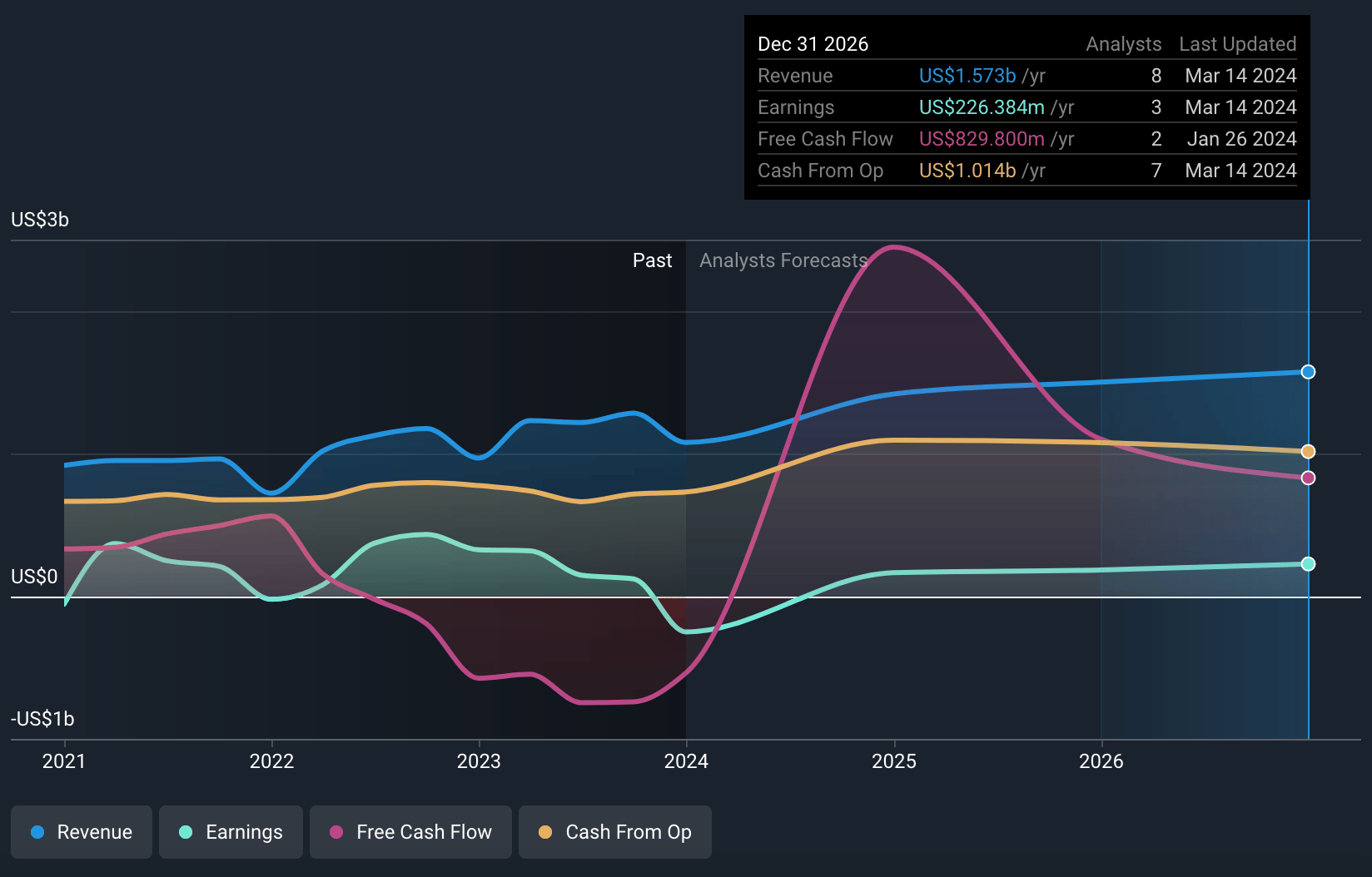

- Analysts are assuming NextEra Energy Partners's revenue will grow by 13.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -23.2% today to 14.4% in 3 years time.

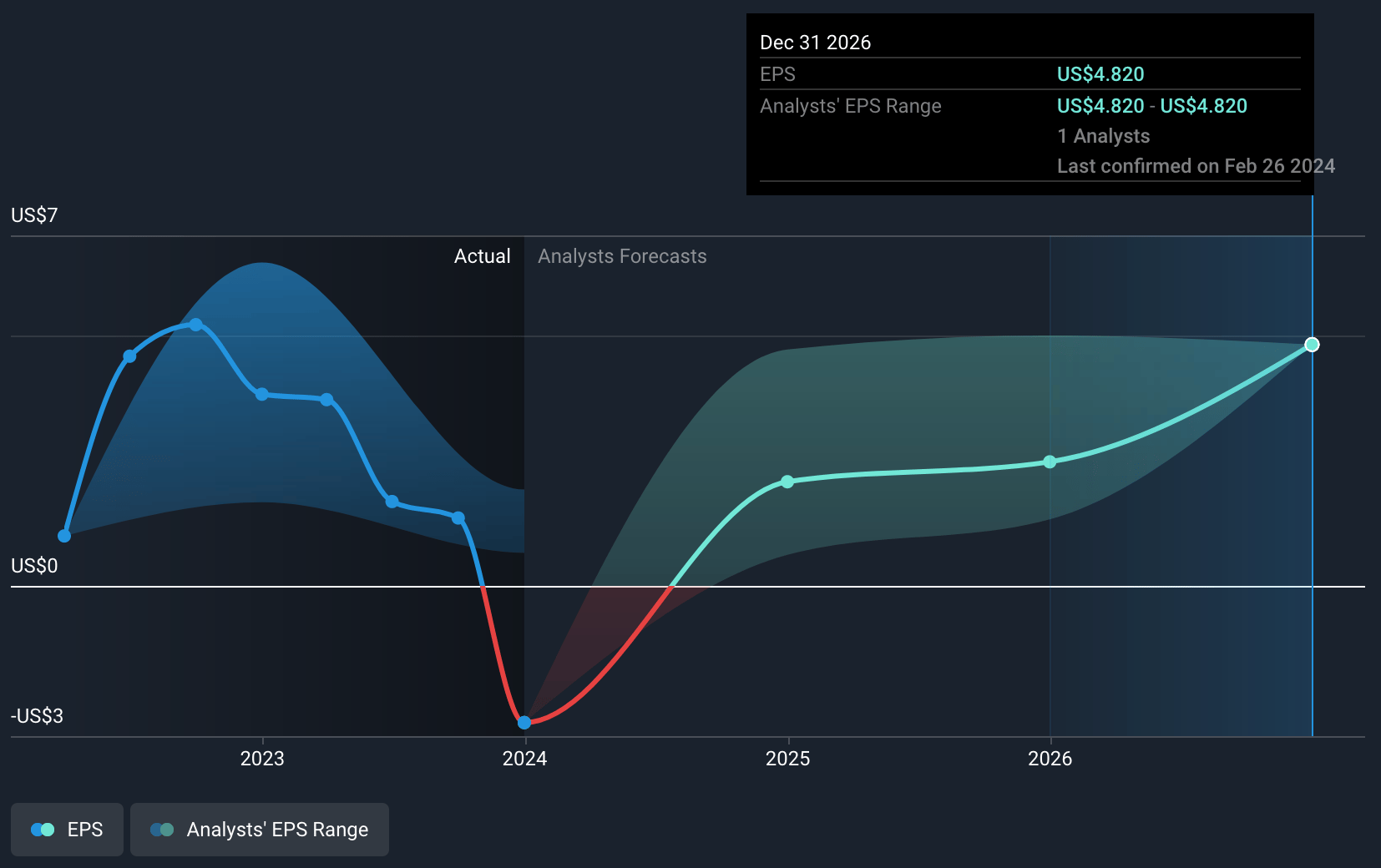

- Analysts expect earnings to reach $226.4 million (and earnings per share of $4.82) by about March 2027, up from -$250.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2027 earnings, up from -10.4x today.

- To value all of this in today’s dollars, we will use a discount rate of 7.53%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Higher inflation and interest rates could negatively affect financing costs, impacting earnings margins and capital investment capabilities.

- Supply chain challenges, particularly in the solar industry, despite improvements, could lead to project delays or increased costs, affecting gross margins.

- Competition for renewable projects is intensifying, especially with the push towards electrification and renewable penetration, which could pressure profit margins and market share.

- Regulatory risks, including changes in tax credit structures or state-level renewable mandates, could impact forecasted growth rates and profitability.

- Dependency on project financing and the evolving landscape of tax equity markets could introduce uncertainties in funding growth initiatives, potentially impacting the company's ability to execute on its renewable project pipeline and affecting net income.

valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of $35.12 for NextEra Energy Partners based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with this, you'd need to believe that by 2027, revenues will be $1.6 billion, earnings will come to $226.4 million, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $27.91, the analyst's price target of $35.12 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company’s future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.’s analysis may not factor in the latest price-sensitive company announcements or qualitative material.